Pros & Cons in 5 Real Estate Investment Strategies

While frequenting other REI blogs online, we saw a common frustration pop up again and again…

There’s just no right way to invest in real estate!

So many investment books, blogs and other advice sources each seem to say a different thing. Often, one contradicts the other and new investors are left without a clue as to how to successfully learn about real estate investments and put that knowledge into practice.

Never fear! The Investor's Edge aims to make real estate investment as simple as possible for the borrower just starting out. Therefore, we’ve broken up five different beginner REI strategies into pros and cons. That way, you can make more informed decisions and choose which path is best for you. This, in turn, will lead you to greater investment success in the long run.

Buying Cheap vs. Buying Higher-End

Pros to Buying Cheap Properties

- You get much more profit out of the overall deal, providing the property is in a good location.

- Your loan could potentially have a lower payback amount and therefore, lower interest.

Cons to Buying Cheap Properties

- It’s always selling cheap for a reason. There may be too much wrong with the property to gain any kind of profit in the end. Therefore, the rehab costs may end up being too high.

- The property may be selling cheaply due to a terrible neighborhood. If the area is horrible, there’s no way you’ll be able to resell the house, no matter how well you execute the rehab.

Pros to Buying Expensive Properties

- These properties have less issues overall and are therefore much less of a headache to rehab. The fix-ups will be mostly cosmetic in nature.

- You can make a solid profit if the property is in a good area with good neighborhood comps.

Cons to Buying Expensive Properties

- It’s impossible to purchase a property like this if you’re just starting out with no earnest money and no collateral.

- Typically, you can only fix-and-flip expensive properties if you have a large down-payment, a high amount of earnest money or cash-to-close attached to the deal or years and years of previous investment experience.

- Since the property costs more, you may not make as large a profit in the long run as you could with a less-expensive property. Again, it all depends on the location.

Finding a Business Partner vs. Going It Alone

Pros of Finding a Business Partner

- If you have poor credit, a business partner will help you qualify for loans.

- If your business partner is more experienced in real estate investing, you can learn a great deal about the process without risking too much.

- You have an extra perspective to help make guided decisions in the process.

Cons of Finding a Business Partner

- You have to split the profits with your partner, giving you a smaller overall cut.

- If your partner is untrustworthy or flaky, you can be left with mess after giant mess and even lose your profit altogether.

Pros of Going It Alone

- You learn a lot more about the fix-and-flip process by making the choices and learning from potential mistakes firsthand.

- You get to keep all of the overall profit.

Cons of Going It Alone

- The points and interest rates of hard money loans will be larger if you have a lower credit score.

- You assume all of the risk yourself and have no one to fall back on or support you if things go south.

Fixing & Flipping vs. Renting for Profit

Pros to Fixing and Flipping

- You receive a fast, large profit. Our borrowers see an average of $30k per deal, and typically see the profits land in their bank account within 3-5 months. This depends on how quickly they can finish the rehab and sell the property.

- Fixing and flipping helps you get out of debt quickly and start a profitable business. If you’re looking to start your own business, fixing and flipping is the best option. Flipping can replace your day-job salary.

- You learn a lot more about the REI industry in going through fix-and-flips firsthand.

- You’ll be spared the headache of having to worry about long-term repairs and bad tenants.

Cons to Fixing and Flipping

- You still have to work at it. Fixing and flipping is a difficult business to learn, but once you do, you can earn a great deal of money. However, profits from fixing and flipping are known as active income. If you stop flipping, the profits stop coming in; just like if you quit your job, the money stops, too.

- Taxes on flipping income is generally taxed like self-employed income – and the self-employed pay the highest income taxes. However, depending on the profit you earn from each deal, taxes could be considered chump change in the long run.

Pros to Renting for Profit

- Renting provides what’s known as passive income. This profit comes without much effort and you’re spared the trouble of having to fully renovate and sell a property quickly.

- The checks keep coming regularly. If you’re looking to save for retirement, renting can be a good investment.

Cons to Renting for Profit

- You have to put up with bad tenants and consistent repairs. If you want your own life, this may not be the choice for you.

- Profits are MUCH smaller in comparison. Although they come consistently, they aren’t nearly enough to replace an income. They may be enough to supplement an income, but definitely not to replace one.

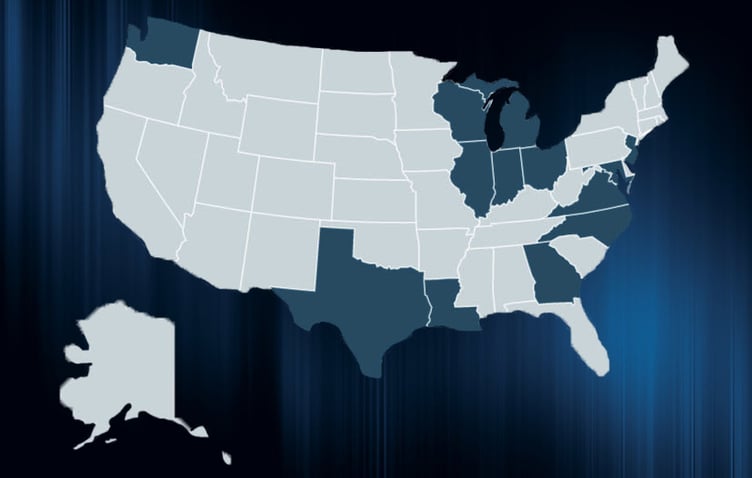

Investing In Your Home State vs. Investing Out-Of-State

Pros of Investing In Your Home State

- You have the ability to visit the property site anytime to check on the rehab progress and oversee the work personally.

- You have the benefit of knowing the better areas/neighborhoods in which to look for a good property.

Cons of Investing In Your Home State

- If your home state currently experiences ridiculously expensive real estate markets (or terrible ones with no profit), you’ll want to look out-of-state.

Pros of Investing Out-Of-State

- Your options are limitless. You can invest anywhere you choose, which is a huge advantage once you research the best areas for profitable fix-and-flips.

- You can potentially find more affordable properties in out-of-state markets.

Cons of Investing Out-Of-State

- You have to deal with unfamiliarity with the market. Not knowing the best neighborhoods/areas to live can prove a great disadvantage.

- You won’t get as much firsthand involvement with your deal as the distance will keep you from the opportunity to visit the site frequently or monitor progress.

Finding a Mentor vs. Learning from Experience

Pros in Finding a Mentor

- Your mentor made all the mistakes in real estate investing so you don’t have to. You can learn a ton of shortcuts and tips with a mentor and know which common pitfalls to avoid.

- You have constant support as you go through the fix-and-flip process, which alone is worth its weight in gold.

Cons in Finding a Mentor

- Depending on the mentor, it can cost a pretty penny to learn about real estate investing.

- Also, depending on the mentor, you can throw a lot of money down the drain and not get much in return with a bad mentor.

- Your mentor may have misguided information or mismanaged time which won’t help you improve at all.

Pros in Going It Alone

- You get to choose your mentor and you have a large wealth of information to choose from! Unlimited REI tips and resources exist online to help guide you through your journey absolutely FREE.

- You learn from all of your choices and mistakes firsthand and find out which strategies work best for you.

Cons in Going It Alone

- You won’t have the benefit of learning from someone who’s been there and done that in the real estate investment business.

- You won’t have the consistent support and encouragement from a mentor to help keep you motivated in finding and flipping deals.

There you have it! We really hope these pros and cons have helped shed some light on how to start investing with your best foot forward. The Investor's Edge is here to help you open the door to financial freedom. We’re far more than just a lender… we also provide a wealth of tools, resources and information to help you learn how to find, rehab and resell properties quickly and efficiently, maximizing your overall profit!

Learn how to make money flipping properties with us by registering for our next webinar.