When people are talking about getting into the real estate game, many of them look specifically at rental properties. There’s nothing like a little extra cash-flow each month to improve your standard of living. But how do you evaluate a potential rental property?

In order to evaluate a potential property, you’ll need to look at factors in the surrounding neighborhood, such as crime, streets, schools, commercial areas, railroad tracks, boarded up homes, and of course, calculate profit potential.

Let’s dive into those factors (and more) in this thorough guide I’ve put together.

Crime in the Area

I’ve said this before and I’ll say it again: if I wouldn’t let my wife walk down the street by herself at night, I’m probably not going to get into that rental property. If I find a place unappealing, then any renters will do the same research and come to the same conclusion.

Many of those would-be renters will either flat-out walkaway, or only stay for a massive decrease in price.

Here’s a handy chart for how I look at crime in a specific neighborhood:

| Violent Crime (Stay Away) | High Crime (Be Very Cautious) | Low Crime (Consider) |

|---|---|---|

| Shootings | Battery | Vandalism |

| Shots tired | Burglaries | Traffic violation |

| Illegal discharge of weapons | Robberies | Drug possession |

| Stabbings | Assault | Theft |

| Murder | Aggravated assault | Shoplifting |

| Body found | Assault with a weapon | Domestic disturbances |

| Sexual assault/rape | Motor vehicle theft | Identity theft |

| Obscenity | Complaints | |

| Fraud | ||

| DUI |

How to Understand Crime

- Find local area crime reports on Google.

- Call the local police station

- www.cityprotect.com

- www.neighborhoodscout.com

- www.familywatchdog.us/default.asp

- www.spotcrime.com

Busy Street

One rule of thumb to ask yourself when figuring whether to move forward with a rental property:

Would you want to live there?

I understand, maybe you’ve grown out of living in rental properties, but imagine yourself just out of college… or maybe when you had young kids…would you have moved your family to that house to rent?

And without a doubt, one of the most unappealing things for a family is busy roads!

If there is a 4-line street (like the dreaded double-double yellow line) in front of the property, I’ll walk away.

If there is a 2-line street, I’d have some concern, but would maybe move forward with it if I think the rental is incredible. Like I’d have to be sure that all the other numbers on it look great and that I’ve got a good shot at decent monthly profit.

Now…I do have a caveat.

I’ve had some success in the past if there are busy streets behind the house, but there must be a LARGE fence in between! It can’t just be a chain link fence or a rickety 3-foot wooden fence. I want something that’s going to block out the view of the road as well as most of the sound. A giant stone or brick wall will do the trick.

For your reference, here at The Investor's Edge we do evaluations all day long for potential fix & flip properties. If a house is near a busy road, we instantly reduce the amount we’re willing to lend on that property by a minimum 5%. That’s how devastating busy streets can be to the value of a property…or in this case, what you charge in rent.

How to Determine Busy Streets

- Google Maps

- Drive over there and walk around the property. Focus not only on what you see, but what you hear

School District

Honestly, this is the first thing I look up and it’s the most important factor.

Typically if an area has good schools, it will also have low crime and be a good neighborhood. No one is going to rank a school high that’s located in the middle of a junky, crime-riddled neighborhood.

Obviously those factors together will make an appealing area for a family to rent.

How to Determine Good Schools

www.greatschools.org – type in the property address and they will show you all thes schools nearby, ranked from 1 to 10.

Is it too Good to Be True?

Here’s a little interjection before I get on with the list…but this is crucial.

Always, always, always ask yourself:

“Why am I getting a good deal on this rental property?”

Let’s say that you can get a great price on a rental property, but it’s right next door to a strip mall. You’re going to have to pass that discount onto your renters, meaning you’re not getting quite the deal you thought you were going to get!

You’ll find these all the time, and it’s so seductive to get into one. Our members show us these discounted properties and try to explain why there’s will somehow fetch a higher price. Just…stay away.

On the other hand, if there are legitimate reasons for a discount, then you’re good.

For example:

- Is the owner in a bind and needs to move out?

- Is the owner completely frustrated with the property?

- Is the current owner tired of being a landlord?

Those are real reasons, and might mean you’ve found a gem of a rental property (especially if you can fix it up and rent out for higher prices…we’ll talk about that later).

Of course, you can also pay full price on a property, but you should know that you’re probably not going to make a ton of cash flow in the beginning. This is a long-term play with your eyes on growth and appreciation in the area.

Railroad Tracks

I won’t spend much time on this one…because it’s fairly obvious, right?

If the property is close to railroad tracks, be cautious. If it’s like right next door, I’d stay away from it altogether.

How to Determine Railroad Tracks

- Google Maps

- Go to the home

Commercial Areas

This is an interesting one, and one that you kind of have to “feel out.”

One of the top factors when people look to buy or rent is how close the essentials are, like grocery stores, Walmart, hardware stores, and even fast-food restaurants. People don’t want to drive 15+ minutes to pick up some milk.

Of course, they also don’t want to live in Walmart’s backyard!

How to Determine Commercial Areas

- You can look on Google Maps, but this is more of a “feel” one for me. Go to the property, pay attention to what you hear, see, and…smell. Yep, if you’re too close to a sewage treatment plant or even to something like a Burger King, that smell can be off-putting.

- Drive from the house to the commercial areas. Is it a short, pleasant drive? That makes more of a difference to a potential renter than you might think

Owner Occupied in Area

This might seem counterintuitive at best and hypocritical at worst, but your best tenants don’t want to live in areas with a high number of rentals!

Interesting right?

Your best tenants want to enjoy the benefits of a stable neighborhood, with home owners around them that are likely to stay longer than renters.

These types of areas will usually create renters with high pride of ownership. They’ll treat the property like it’s their own because they might be thinking about staying there longer. They’ll mow the grass, trim the bushes, and even fix things on their own (like paint touch ups).

I like my areas to be 70% homeowners or higher. One telltale sign is to stay away from areas with apartment buildings. They won’t be desirable to your renters of your single family property.

How to Determine Owner Occupied in an Area

- www.Rentler.com

- www.Rent.com

- Google “rentals in my area”

- Drive the area and look for pride of ownership. How do the lawns look? The landscaping? Is there garbage around the property? Is anything broken on the exterior? If there are too many properties with low pride of ownership, they’re either rentals, or just bad homeowners…either one is unappealing to have nearby.

Boarded Up Homes

These are the homes in the area that have boarded up windows or doors. These are obviously bad signs of vandalisms, someone unlawfully moving into the home, or just a property that’s been vacant for awhile.

Ideally, you don’t want to see any homes in the area like this, but you’re okay if there are 1-2 in a 5-block radius. If there is one on your same street, it’s definitely a concern.

How to Determine Boarded Up Homes

- Someone needs to drive the area

- www.taskrabbit.com – a nifty tool where you can hire someone for cheap in the area to drive around for you and look for boarded up homes. This is great if you’re too busy or don’t live close by.

Vandalism on the Property

Vandalism is a good indication that it’s an area with low pride of ownership. Sure, you could obviously clean up the property, but it’s fairly likely to happen to you again…and even perhaps theft or worse destruction on the property itself.

How to Determine Vandalism

- Simple enough…take a tour of the property!

Ranking Your Rentals

Let’s talk about the quality of the rental that you want. You can tell from some of the points I’ve made above that I’m certainly not into C- or D-level rentals. You’ll have too much turnover, too many repairs, lower quality tenants, and just more costs and hands-on management overall.

But I also don’t look for A-level rentals either. In those cases, you’ll pay more to acquire the property, but can’t rent them out for appreciably more than B-level properties.

That’s why most of my rentals are in B-level areas. You’ll find good schools and good neighborhoods, typically blue collar areas, with pretty decent properties. This is the sort of thing that you’ll just know it when you see it.

You don’t want the cheapest OR most expensive rents in the area.

Ways to Make Money on Rentals

There are four main ways that you’re going to be able to make money on your rental properties…let’s talk about each one and what it means for you as the owner!

Appreciation

With appreciation, you make money simply by having more equity in the property! While it isn’t cash flow, it does give you more options down the road. You can resell for more money, refinance for cash or for a better rate, or take out a line of credit against the property.

It’s like the old saying…

“Don’t wait to buy real estate, buy real estate and wait.”

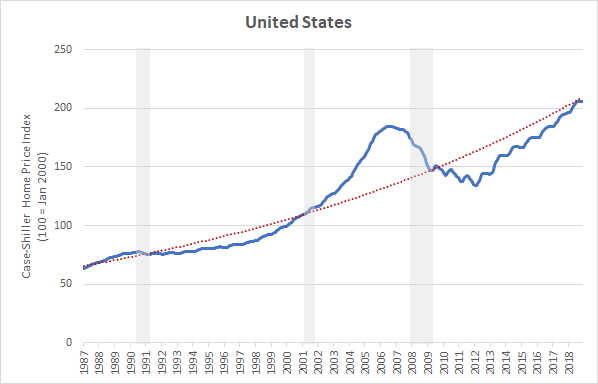

Case in point:

If you wait long enough…you’ll pretty much always come out ahead in real estate…and come out significantly ahead.

Dollar-Cost Averaging

One way to take advantage of appreciation, and limit the impact of those short-term dips (thanks 2008!), is to do what’s called dollar-cost averaging.

In this scenario, you have an amount that you’d like to invest, but then you invest that over a period of time. This reduces the impact of volatility in the overall purchase.

For example:

You buy a new rental property every year (or every few years). Some houses you buy low, others you buy high. But overall, your average works out.

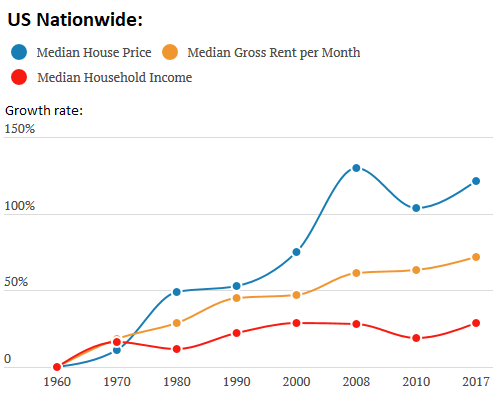

Just take a look at how rental prices have changed over the years:

Debt Pay Down

The next incredible way that you earn money over time with your rentals is through paying down your debt.

This happens through a process called amortization, which refers to the schedule at which you pay off your mortgage over a 30-year period. When you buy a property, you’ll get an amortization schedule, or you can look one up online.

Here’s an example for just a year:

In the beginning, most of the money goes towards your interest, which means you’re not gaining much equity. Banks do this to minimize their risk. If you sell the property fairly quickly, they’ll still have made a decent amount of money through interest. It also incentivizes you to stay in the loan longer, which is also beneficial to the bank.

But by the time you’re closing in on your 30 years…

Most of your money is going towards the principal, and less towards interest!

The best part of all this is…

The tenant is paying for this! They’re basically giving you equity in the property. So now if your home appreciates in value, and your tenant is paying down the mortgage, then you’ll be able to create equity fairly fast without using any of your money!

Tax Benefits

Here’s another often overlooked benefit of owning rental properties! The cash flow is great, but many don’t realize that there are plenty of tax benefits as well.

Depreciation

My definition of depreciation is the cost to keep a property in good condition. As things start to wear out, it costs you money to replace those things. Because this is a business investment, the IRS allows you to deduct these costs.

The IRS has set the useful life of residential real estate at 27.5 years.

So let’s say that you have a property worth $150,000. If you divide that by 27.5 years, that means you can deduct $5,454 per year!

(Remember, a deduction lowers a person tax liability by lowering their taxable income. These deductions may even get you into a lower tax bracket)

Now, there’s something called accelerated depreciation…

You can have an assessment done on your property to figure out the life of each item in the home, instead of the standard 27.5 years for everything.

There are many items that may only have a useful life of 5-10 years, meaning you can deduct more in those first several years!

Deferral of Capital gains 1031 Exchange

Here’s another tax benefit that you must be aware of if you’re going to be getting into this heavily!

When you sell an investment property, you’ll have to pay capital gains on the income you make.

Except…

When you use what’s called a 1031 Exchange.

This means that you’re going to take the profit you make on selling the property (like if you get tired of a certain rental property or the market is really high), and roll it into a new investment property!

That money doesn’t get taxed at all. I love this. I use this all the time.

Property Expenses

If you’ve dabbled in a side hustle, or even owned your own business, then you know that you can deduct business expenses from your taxes.

For example, if you buy a laptop that you use only for your side business, you can deduct 100% of the cost.

It’s the same thing here with property expenses! This is your business, so what you spend on it can be deducted.

I’m talking about expenses like:

- Repairs

- Maintenance

- Upkeep

- Property Tax

Services

The next tax benefit you can write off are services!

These include things like:

- Legal (discussing eviction with a lawyer, writing contracts)

- Consulting

- Utilities

- Property management expenses

- Cell phone

Business Expenses

And the last is your overall business expenses related to owning/managing the property.

- Car

- Gas

- Office Supplies

Basically, if you pay for it and it’s used for the property, you can get a deduction.

Cash Flow

Alright, here’s the biggest reason you likely got into rental properties in the first place…

Cash flow!

In my opinion, passive cash flow is the ultimate goal for any investor. I’m a big fan of fix & flips and other types of investing that give you a one-time payment.

However, I usually use the profits from those investments to create more monthly cash flow! Often those are rentals.

The rest of this article will be about how to calculate the financial viability of your rental, and what I do to maximize the profit from my own rentals!

Determining Financials of your Rental

I don’t have some crazy formula for figuring out profit, but generally what I do is to look up comps in the area. Are you getting a good price on the property? What are the rents in similar properties close to yours?

(Read my post about how to establish values using comparable properties)

My first big tip: Have your rents be $50 less than everyone else in comparable properties! This is hard for a brand new investor to do…your instinct will be that you can’t just give away $50 per month.

But in my experience, taking the long view always pays off. You charge less so that you have happier tenants who are willing to stay longer. The most expensive thing a landlord can have is a vacancy. A slight discount in rents help discourage that.

Expenses

When figuring the monthly cash flow, it’s pretty obvious how to do the base calculation:

Rent – mortgage = your monthly cash flow!

But of course it’s never that simple. Here are a few things that you’ll need to figure in:

- Hazard insurance

- HOA (if one)

- Utilities (I always make my tenants pay for these, including water, sewer, and garbage)

But there are other expenses:

Maintenance

One cost that many rental owners like to do is to get a home warranty to cover the big things along the way.

My advice: don’t blindly purchase these.

It’s all a numbers game. If you can justify the cost, then go ahead. However, most studies show what people lose money when purchasing a warranty (which is how the company makes money on it!).

I don’t do these, but it can help give a new investor some peace of mind.

Capital Improvements

These are additions/improvements you make to the house that will increase its value.

Most people don’t budget for capital improvements/repairs. I always budget 5% of my monthly rent for these two things and put them in a separate bank account.

Pro tip: put this money in a high yield savings account! If you haven’t seen these before, they’re savings accounts but with interest rates much higher than sticking your money in a regular checking/savings account at Wells Fargo.

They won’t make you rich, but they’ll typically give you 1% – 2% return. For me, it’s more the mindset of having my money be doing something.

Vacancy

Like I said above…the most expensive cost for a rental owner is typically vacancy!

(You know, unless something happens like a flood and you don’t have insurance)

During those months, it’s YOU covering the mortgage! I budget 5% of the rent each month for vacancy as well.

One thing that I always do is have my old tenant show the property to the new tenant so I don’t have to show the property. This also reduces turnover!

Property Manager

If you’re unwilling to manage the property yourself, you can always hire a property manager. However, they are going to eat into your profits fast.

They typically run about 8% – 10% of your rent…which is why I always manage my own properties. If you follow the tips I’ve talked about in this post, you can reduce turnover, increase pride of ownership, and have fewer emergencies to deal with.

In fact, I can’t remember the last time that I was called for an emergency. It just doesn’t happen with my properties.

Profit Example

Here’s a typical rental example for me:

You have looked at the comps and know that your property will rent for $1,000.

You discount by $50.

So rent is now $950.

Now for expenses:

Loan payment: $500

Hazard insurance: $34

Property tax: $100

HOA: Let’s say there isn’t one

Property Management: You do your own

Capital Improvement: 5% for $50

Vacancy: 5% for $50

Net Profit: $166

Not bad, eh? Then if you don’t have any vacancies or improvements/repairs needed, then you’re doing even better than that!

Also remember that you’re making money from appreciation, tax deductions, and paying down your debt at the same time.

Now, looking at those numbers, you might wonder how I can get rents to be $500 more than what I’m paying for in the mortgage.

Well, there are a few ways. I’m always looking for discounted properties. It’s what I’ve been doing for 20 years and will keep doing. Even my primary residence was one that I got from a motivated seller at an extremely low price.

So you need to be on the hunt for a property as if you’re looking to fix & flip it.

In conjunction with that, you can do what’s called a BRRR deal. That stands for Buy, Rehab, Rent, Refinance. Basically, you find a discounted property, rehab it so it’s worth quite a bit more and you can charge higher rents, find your renter, and then refinance the property with a conventional 30-year loan.

Conclusion

Rentals are an underrated wealth building tool. Not only do you have an incredible asset that will be worth way more in the coming years, but you don’t even have to pay for it month over month!

I can’t stress enough how amazing it is to have someone else pay your mortgage, get tax deductions, and have monthly cash flow!

And a great part is that your monthly payments stay the same, but you’ll almost for sure be able to raise rents over the years! And if you keep it long enough, you could have a property where you don’t owe a monthly payment and ALL of the money goes straight to your pocket.

Invest in a few properties over the next several years, and that could easily be your retirement.

Hope this article helps and that you being to see how to evaluate a potential rental property!

Learn how to make money flipping real estate with us by attending our next webinar.

COMMENTS