Experienced investors frequently praise the wealth-building value of real estate. But, for new investors, getting your foot in the door can be a challenge. In particular, many types of real estate investing require two things that most novices just don’t have: 1) money, and 2) good credit. As such, people often ask me how to buy real estate with no money down and bad credit.

You don’t need money and good credit to start investing in real estate. By working through a series of strategies, people can A) raise money, and B) improve their credit scores. After these steps, investors can then actually buy their own real estate – fix & flips, BRRRs, and pure rental properties.

I’ll use the rest of this article to dive into the details of buying real estate with no money down and bad credit. Specifically, I’ll cover the following topics:

- My Thoughts on Buying Real Estate with No Money and Bad Credit

- Step 1: Raise Money by Bird Dogging and Wholesaling

- Step 1a: Use Profits to Improve Credit Score

- Step 2: Increase Margins by Flipping Houses

- Step 2a: Continue Using Profits to Improve Credit Score

- Step 3: Buy Real Estate with the BRRR Strategy

- Step 4: Begin Buy and Hold Investing

- Final Thoughts

My Thoughts on How to Buy Real Estate with No Money and Bad Credit

Unfortunately, the investing approach of using traditional mortgages to buy real estate comes with two major challenges.

Challenges to Real Estate Investing with No Money

First, investment property mortgages require a down payment – typically 20% to 25%. For example, say you want to buy a $250,000 investment property. With a traditional mortgage, you’d need at least $50,000 cash as a down payment. That’s a lot of money! And, most new investors just won’t have that sort of cash sitting in the bank.

Money serves as the largest obstacle to buying a house. As an investor, if you don’t have money for a down payment, purchasing a property can be extremely difficult. But, as I’ll outline below, it’s definitely not impossible. Actually, with the right strategies, investors can execute some extremely profitable deals with little to no cash.

Challenges to Real Estate Investing with Bad Credit

The second major challenge to using traditional mortgages involves credit. For better or worse, people judge us by our credit. Landlords, banks, and credit cards (among others) view us through the lens of our credit scores. If you have good credit, people deem you a reliable borrower. Conversely, bad credit leads many people to categorize you as unreliable or, at worst, untrustworthy.

This credit score judgment translates directly into dollars and cents for real estate investors. If you have bad credit, most traditional lenders will not provide you a loan. Simply put, you won’t be able to secure a mortgage for an investment property. And, even if you do get a loan, a bad credit score will mean you’ll need to pay higher interest rates. Higher rates can translate into tens of thousands of dollars in additional interest charges over the life of a loan.

Can you invest in real estate with bad credit? Yes, absolutely, and I’ll outline different strategies to do so in this article. But, good credit definitely makes investing easier.

The Path Ahead

Having outlined the above challenges, I want to reiterate: investors don’t need money for a down payment and good credit to get started in real estate. Yes, you’ll need both of these eventually, but not having a lot of money or credit now doesn’t mean you can’t begin your path to buying a portfolio of rental real estate.

In the next few sections, I’ll outline a step-by-step progression I recommend new investors take. If followed, the below steps will take you from having no money for a down payment and bad credit to having plenty of money and a great credit score. And, during this process, you’ll arm yourself with the skills, money, and credit to start buying investment properties.

Step 1: Raise Money by Bird Dogging and Wholesaling

For the sake of this article, I’m assuming that readers have no money and very poor credit. That’s fine! The two investing strategies I discuss in this section – bird dogging and wholesaling – are absolutely perfect for new investors in these situations.

Bird Dog

Bird dogging offers an awesome, low-risk way to get your foot in the real estate world. And, it doesn’t require money or good credit. To make money, you’ll absolutely need to work hard and learn a lot. But, if you make a mistake on a deal, you won’t lose tons of invested money in the process.

Here’s how it works. A lot of real estate investors make money through wholesaling, which I’ll discuss next. But, in a nutshell, wholesaling requires investors to find deals to bring to other investors. While the wholesalers themselves can certainly do this searching legwork, they often pay other people – bird doggers – to do it for them.

Bird doggers spend their time looking for a certain sort of deal. They want to find distressed properties that won’t qualify for traditional financing. In other words, traditional mortgage lenders want to make sure a house is actually habitable. Bird doggers look for properties that don’t meet this standard. Next, the owners of these properties need to have A) some equity in the property, and B) some reason for wanting to sell – often to turn that equity into cash.

As bird doggers find leads on situations like this, they pass them along to wholesalers for a fee. They may receive a fee for every lead, or it could be a contingent payment based on the lead actually converting. It ultimately depends on the relationship you have with a particular wholesaler. But, regardless of payment structure, bird dogging provides you an outstanding opportunity to gain some real estate investing experience with little to no barrier to entry.

Wholesale

Once you’ve bird dogged for a while, you can make the jump into wholesaling properties yourself. This investment strategy lets you make money without needing to actually purchase properties. As a result, it represents a great approach for new real estate investors working on gaining experience.

As stated, with wholesaling, you don’t purchase an investment property. Instead, wholesalers find off-market properties, and they enter contracts to purchase these properties. Rather than close on the purchases, they assign the contracts to a third party, typically a fix & flip investor. And, they assign these contracts for a fee. As such, wholesalers find deals, connect the sellers with investors, and collect a fee in the process – all without dealing with the headaches of doing any rehab work themselves.

When you wholesale, you learn very quickly how to spot good deals for fix & flip investors. If you don’t find good deals, you won’t be able to assign contracts to these people. Simply put, you learn what to look for in a property. Additionally, you have to work closely with house flippers. This gives you the added benefit of learning from them. Pick these people’s brains. They have tons of experience, and you can learn from it. Lastly, wholesaling puts money in your pocket. If disciplined, you can allocate a portion of these funds for a down payment to purchase your own fix & flip property.

Step 1a: Use Profits to Improve Credit Score

In this step-by-step process, investors will want to set part of their profits from bird dogging and wholesaling to fund future deals. But, disciplined investors will also pour some of that cash into improving their credit scores. While good credit isn’t required for either of these initial strategies, to eventually buy real estate that you plan on holding in a portfolio of rental properties, you’ll need good enough credit to qualify for traditional financing.

So, having outlined the importance of credit, real estate investors need to take a step back. Before asking how to buy real estate with bad credit, they should ask how can I improve my credit score? Frankly, real estate investing and improving your credit score aren’t mutually exclusive. You can focus on improving your score while still investing.

As such, start improving your score as soon as possible. It can take a while to see results, so the earlier you start, the better. And, improving your score will open more investing opportunities in the future.

Broadly speaking, you have two options to improve your score:

- Do it yourself: You can request a free copy of your credit report from any of the major credit bureaus (e.g. Experian, Equifax, etc.). This report will outline the major items hurting your credit score. You can use this report to gradually improve your score. But, for most people, you need to do two things to improve your score: 1) pay your bills on time, and 2) pay down your outstanding debt.

- Hire a credit repair company: Alternatively, you can hire a company to guide you through the credit repair process. This can help if you have incorrect information on your credit report. And, these companies typically don’t cost too much. For roughly $50 per month, you can hire a credit repair company.

Whichever route you choose, start now. The sooner you improve your credit, the sooner you’ll qualify for more loans and better rates.

Step 2: Increase Margins by Flipping Houses

Next, investors can begin flipping houses. To technically answer this question, yes, when you fix & flip a house, you inherently buy real estate. But with these deals, you only hold a property for a limited period of time before reselling it at a profit. House flipping doesn’t directly lead to a portfolio of rental properties. But, it is an important step on the journey towards that goal.

In particular, the above strategies will give you the cash and experience to make the jump into house flipping. That is, as a fix & flip investor, you need to understand everything wholesalers do about finding good deals, and you need to have some cash (though not as much as a traditional down payment would require). But, you also need to understand how to rehab and sell these properties. Broadly speaking, the fix & flip strategy works like this:

- Step 1, Find and buy a distressed property: Investors need to find properties that need rehab work to qualify for traditional financing. And, these properties need to make financial sense. That is, the purchase price and all rehab-related costs need to be less than the projected final sale price to make a profit.

NOTE: House flippers usually buy and rehab these distressed properties with hard money loans. These lenders provide hard money loans primarily against the hard asset – the property. Rather than approve loans based on someone’s personal financial health (like the traditional financing outlined above), hard money lenders base their decision on the quality of the deal itself. In other words, will the after-rehab value (ARV) of the property justify a loan to purchase and rehab the distressed property? Accordingly, as investors work on improving their credit scores and saving cash, they can still qualify for hard money loans to flip homes.

- Step 2, Rehab the property: After purchasing a distressed property, house flippers need to renovate it to a standard that A) qualifies for a traditional mortgage, and B) appeals to potential buyers in that particular market. This requires an in-depth understanding of renovations, working with contractors, and creating accurate rehab budgets.

- Step 3, Sell the property: Finally, house flippers need to sell the property. Typically, these investors sell to primary homebuyers. That is, they sell to people looking to buy their home – not an investment property. This requires an understanding of sales and pricing strategies, and a solid analysis of the local market.

The above provides a simplified overview of the house flipping system. However, it should be clear – this strategy takes far more knowledge and experience than bird dogging or wholesaling. But, it also provides investors far greater returns. And, during the house flipping process, you’ll inevitably make mistakes. As you work through a few deals, you’ll quickly gain a tremendous amount of experience.

But, more importantly, flipping generally offers far higher returns than these other two strategies. Once again, disciplined investors should set a portion of their profit aside as capital for future deals.

Step 2a: Continue Using Profits to Improve Credit Score

With the remaining flipping profits, though, investors should now begin to aggressively pay down outstanding debt to improve their credit scores. According to the credit reporting agencies, two factors make up 65% of your credit score: 1) payment history (35%) and 2) amounts owed (30%).

Using your wholesaling and bird dogging profits, you should at least be able to focus on that first factor: paying your bills on time. That is, if you have credit card debt, a personal loan, or any other sort of outstanding credit, make sure to pay the bills on time! But, that’s only half the battle. To really start improving your credit score, you need to seriously pay down the amount of debt you have outstanding, as this makes up another 30% of your credit score.

For example, say you have $30,000 of outstanding credit card debt. Yes, paying the monthly bill on time helps a ton. But, if you pay the bare minimum, you’re going to be paying off this debt for a thousand years! Instead, assume you average $20,000/deal on each flip. If you flip three houses in a year – not unreasonable – you can allocate half of each deal to paying down debt and the other half for saving for future investments. By the end of that year, you’ll have A) $0 in credit card debt, and B) $30,000 set aside for a down payment on a future investment property!

When it comes to qualifying for permanent financing, improving your credit score by paying down debt has another major benefit. In addition to requiring good credit, lenders require that borrowers have a certain debt-to-income (DTI) ratio to qualify for a traditional mortgage.

Conceptually, DTI represents the percentage of every dollar of income you use to make monthly debt payments, including the future mortgage. Mathematically, you solve for DTI by dividing all of your monthly debt payments by your monthly gross (pre-tax) income. While lenders vary, many require a DTI of 40% or lower to qualify for a mortgage on an investment property mortgage. Accordingly, by paying down your debt, you reduce your monthly debt payment, thus improving your DTI.

Step 3: Buy Real Estate with the BRRR Strategy

Once you’ve put some money in your pocket and improved your credit score to a point that you’ll qualify for traditional financing, you can finally buy rental real estate for yourself. In other words, after gaining experience, cash, and improved credit in the fix & flip world, investors who want to buy real estate to hold usually make the jump into the BRRR strategy. This requires all of the experience and knowledge of flippers, but now you also need to understand property management and permanent financing. Here are the steps that make up the BRRR strategy:

- Buy: Investors buy distressed properties – ideally at a deep discount – in need of major repairs. As such, BRRR investors largely look for the same properties as fix & flip investors.

- Rehab: Investors then rehab the property. However, they don’t rehab it to sell it. Rather, they do their renovations with an aim to appeal to renters. Rehabbing a rental property usually means picking far more durable materials than if rehabbing for sale. You’ll need materials that can handle the wear and tear of multiple tenants. And, you don’t want to have to complete repairs every year. This rehab leads directly into the next step of the strategy.

- Rent: Once you’ve completed the renovation, you need to market the property for rent and secure quality tenants. You can certainly hire a property manager to do this. This saves you a ton of headaches, but it also costs money. And, from an experience perspective, I recommend investors manage at least one of their own properties. This provides you a solid understanding of the leasing and property management process, and you’ll be better positioned to hire and supervise property management companies down the line.

- Refinance: Once you’ve rehabbed the property and signed a tenant lease, you can refinance the property. Typically, BRRR investors (and flippers) use hard money loans to finance a property purchase and rehab. However, these loans have high interest rates, as they’re designed for short-term investment use. Once a property meets traditional mortgage quality standards and is rented out, you’ll want to refinance into a traditional mortgage. This new loan will pay off the outstanding hard money loan.

As these steps illustrate, BRRR investing requires all the experience and knowledge of flipping homes, with two additional wrinkles. These investors need to understand property management, and they need to have a better grasp of real estate financing. The success of the strategy hinges on refinancing, so that’s crucial knowledge.

However, while requiring more experience, this strategy also provides more profit. With a house flip, you have one-and-done profit. That is, once you sell a property, that’s how much you make – for better or worse. BRRR investing creates long-term wealth. In addition to profiting up-front by pocketing a portion of your refinance proceeds, you continue to make money in three ways.

First, you pocket any rent payments in excess of operating expenses and debt service. Second, you gradually build equity in the property as your tenants’ payments pay down the amortizing mortgage. Third, houses appreciate over time. While they may fluctuate in the short-term, over time (especially a 30-year mortgage horizon), home appreciation historically has outpaced inflation.

Step 4: Begin Buy and Hold Investing

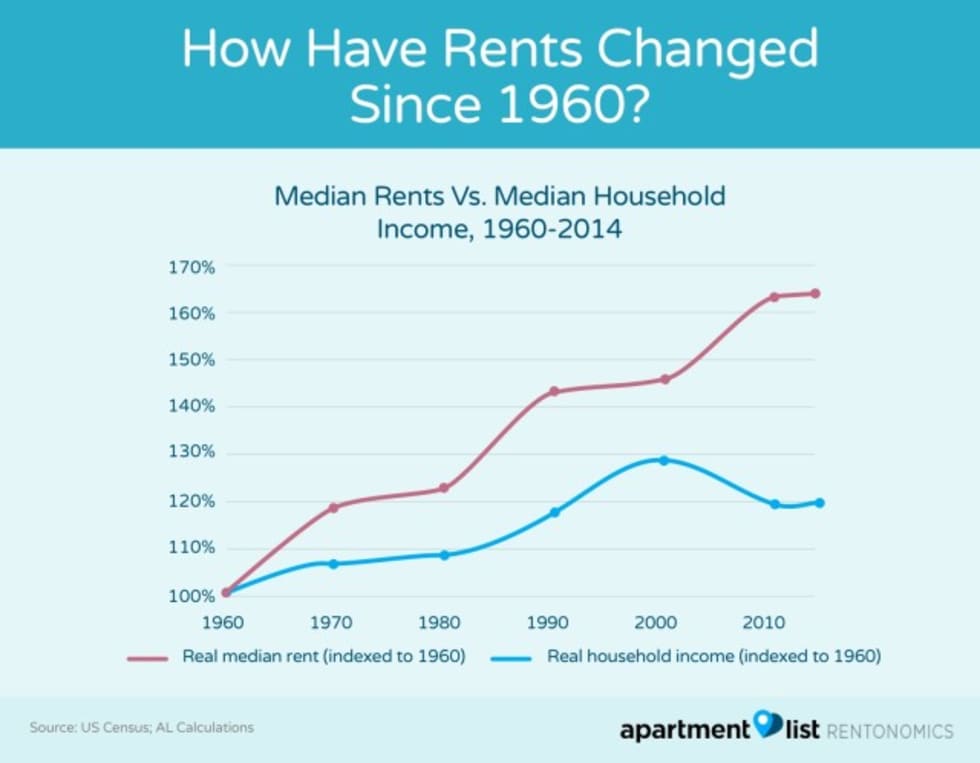

As the above chart illustrates, median rent has dramatically outpaced median household income since 1960. While this poses a challenge to many households, it also demonstrates the long-term profit potential of owning rental properties. In all likelihood, you already understand this value – even if you’ve never seen this chart. That’s why you’re reading this article!

From an investor’s perspective, this chart shows why it makes sense to buy rental real estate. The more investment properties you own, the more rental cash you receive on a monthly basis. However, investors also often get to the point where they no longer want to deal with the hassles and effort of rehabbing a BRRR property. Enter the buy and hold strategy.

With buy and hold real estate, you have the same endpoint as a BRRR deal, that is, an income-producing property. But, the difference rests in how you arrive at that end. Whereas BRRR investors buy and rehab distressed properties, buy and hold investors buy a property that’s ready to occupy, typically at retail price.

On the one hand, this means that you likely pay more for pure buy and hold properties, as you don’t gain the discount of a distressed property. On the other hand, this strategy also requires far less work. You can begin listing the property for rent the day you close on the deal – no rehab period necessary. And, when you properly analyze one of these deals, you can still reap the cash flow, amortization, and appreciation profit paths of a BRRR deal – just with far less work.

But, to buy one of these properties, investors are going to need both good credit and money for a down payment. From a credit perspective, you’ll finance these buy and hold properties with a traditional mortgage. As we’ve discussed, these lenders impose high credit score requirements, and investment properties require even higher scores than primary homes.

From a down payment perspective, most lenders require between 20 to 25% on an investment property. And, due to the fact that you’re paying retail for these properties, that can be a lot of money. For example, assume you find a ready-to-occupy, single-family home for $250,000. With these down payment requirements, you’ll need between $50,000 (20%) to $62,500 (25%) cash, plus another ~$7,500 for closing costs (rule of thumb: closing costs average 3% of purchase price).

That’s a lot of money, which is why this is the last step in this process! When investors ask me about buying real estate with no money down and bad credit, I assume they’re ambitious, motivated individuals who want to keep growing as investors. Eventually, to buy rental real estate, you’ll need to improve your credit scores and put some money aside. By following this step-by-step guide, you’ll do just that. So yes, you won’t be able to jump right into buy and hold real estate, but you will by following these steps!

Final Thoughts

The savviest investors understand the role real estate plays in building long-term wealth. But, for people with bad credit and little money, investing can seem like an impossible goal. Fortunately, strategies exist to begin your investing journeys without money and good credit. It takes time, effort, and discipline, but hard-working investors can absolutely buy real estate, regardless of the fact that they start out with no money and bad credit.

Learn how to flip real estate with us by attending our next webinar.

COMMENTS