Hard Money Loans in South Carolina

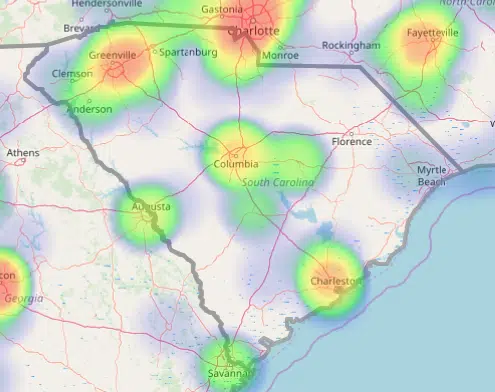

The South Carolina Housing Market:

If you’re ready to start making a profit in house flipping, you’ve come to the right place.

The Investor's Edge offers hard money loans and many other valuable resources for first-time flippers and experienced pros.

You’ll get the money you need to finance flips and professional support to encourage education and growth.

You can get hard money loans from The Investor's Edge even if other companies have rejected you.

Quickly get the funds you need so you can get to work on your next flip.

Why Hard Money Loans Are Perfect For South Carolina Users

Hard money loans have a range of benefits over traditional mortgages.

Mortgages typically require a longer approval process based on your credit, while hard money loans focus on the property’s value instead.

Other benefits include:

Fast Approval: A hard money lender can assess a property and related factors to grant approval within a day.

Flexible Terms: Unlike loans given by a bank, hard money loans often allow for changes in terms and rates.

Less Focus on Credit Scores: Hard money lenders focus less on factors that might raise red flags for banks, such as your credit score.

Hard Money Loans Up To 100%

Funding a fix and flip at 100% is a pretty sweet deal.

It doesn’t happen all the time, but we do it at The Investor's Edge.

If your fix and flip property doesn’t qualify for 100% financing, we’ll show you ways to raise the rest of the cash.

Why Flip Houses in South Carolina?

South Carolina is a profitable location for house flippers for many reasons, including:

- Appreciating housing values: House values have increased significantly in the past few years. Growing values mean you can make more on the properties you sell.

- Growing Population and Job Market: South Carolina has proved to be a popular destination for retirees and businesses. A larger population increases the chances of selling your properties at higher values.

Loan Programs For Flipping Houses

When you have more choices, you get a better fit.

At The Investor's Edge, our private lenders offer 30 loan programs targeted to our customers’ varying needs.

That’s several times more than other hard money lenders.

Real Estate Investing Software

Gain valuable property investing knowledge with our real estate investing software.

It can help you calculate risk on properties you are considering fixing and flipping.

What Makes The Investor's Edge Loans Different?

Why Choose The Investor's Edge?

You want a lender who’s willing to put in the work to help you succeed.

At The Investor's Edge, we equip you with a variety of tools and resources to push you toward success at every step.

If you want the best hard money lender in South Carolina, choose us for:

- Your one-stop shop: Enjoy hard money loans and access to training and software with a simple, one-time payment.

- Market-finding tools: Use our Investor’s Edge software to find the best deals and locate properties before your competitors.

- Dedicated helpers: Take advantage of an assigned loan advisor and project manager to guide you toward meeting your goals.

- Educational resources: Develop your residential real estate skills with our training course and support resources.

Choose The Investor's Edge

Investors choose us because they see that we want to help you, no matter your situation, succeed at real estate investing. Many come because they are excited about our 100% financing program, but then stay for multiple deals because of our commitment to them.

Between our deal-finding software, low-barrier funding, and dedicated team members, you won’t find another lender who makes it easier to find and close profitable deals, period.