Hard Money Loans in Pennsylvania

The Pennsylvania Housing Market:

If you need funding for your house-flipping projects, turn to The Investor's Edge.

We provide hard money loans and many other resources you can’t get from other lenders, including software, funding, and training.

You can get everything you need to be a successful house flipper in one place for added convenience.

With flexible funding, you can achieve your real estate goals.

You’ll get a funding plan that considers your unique needs to give you the best loan experience.

Pennsylvania is a profitable market for house flippers, and the best way to succeed is by using every resource to become the best house flipper you can be.

Pennsylvania Hard Money Loans

Your best loan option as a house flipper in Pennsylvania is a hard money loan.

These loans come from private lenders rather than a large institution like a bank.

Since private lenders fund the loan, they have the flexibility to help you get the best option for your situation.

Consider these additional reasons to get a hard money loan:

Quick Funding Process: You can quickly take advantage of real estate opportunities when you get funding in as little as a few days.

Adjustable Terms: Private institutions have more power to change the loan terms to suit your situation rather than offering fixed terms for each loan.

No Credit Score Requirements: Whatever your credit score, you have the opportunity to get funding with hard money loans. We focus on property value rather than your finances.

Hard Money Financing Up To 100%

Most hard loan lenders require a fairly hefty down payment, but with The Investor's Edge, some investment properties qualify for 100% funding — including closing costs, rehab and more.

If your property doesn’t qualify, we can show you how to get the hard cash you need to move forward.

Why Fix and Flip in Pennsylvania?

Pennsylvania offers various opportunities for those looking to get started fixing and flipping homes.

Whether you call PA home or you’re looking to expand your investing to new areas, there are many good reasons to fix and flip in this state:

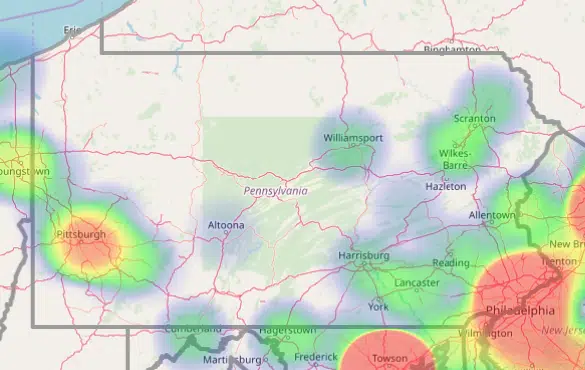

- Hot housing markets: Many cities in Pennsylvania present a lucrative market for house flipping, including Philadelphia, Pittsburgh, Upper Darby, Ridley Park, and Harrisburg.

- High ROI potential: Returns on investments are often higher in Pennsylvania than in most other states.

- Seller’s market: House prices are rising, meaning that as a seller, you can sell houses quickly for a higher amount than usual.

Loan Programs For Flipping Homes in PA

When you want a wide selection of loan programs to choose from, come to The Investor's Edge.

We have 30 loan programs to meet the needs of property investors in Pennsylvania.

That’s more than three times as many as most other private money lenders.

Real Estate Investing Software

When you use our real estate investing software, you’ll learn to calculate risk relative to each property you’re considering flipping.

The Investor's Edge helps beginner investors make good choices when flipping houses in Pennsylvania.

What Makes The Investor's Edge Loans Different?

The Investor's Edge Will Help You Reach Your House Flipping Goals in Pennsylvania

Whatever your goals for house flipping, The Investor's Edge can help you achieve them.

Beyond getting fix and flip loans for Pennsylvania house flipping, you’ll also have access to additional resources that make achieving your goals easier.

Here are some ways we’ll help you:

- Offer training and support: Whether you’re a new flipper or experienced in real estate, educational resources help you keep up with an ever-changing market.

- Give access to Investor’s Edge: This software allows you to easily identify opportunities in hot Pennsylvania markets.

- Provide vast resources: With one payment, you can access training, property records, and funding.

Choose The Investor's Edge

Investors choose us because they see that we want to help you, no matter your situation, succeed at real estate investing. Many come because they are excited about our 100% financing program, but then stay for multiple deals because of our commitment to them.

Between our deal-finding software, low-barrier funding, and dedicated team members, you won’t find another lender who makes it easier to find and close profitable deals, period.