Hard Money Loans in Ohio

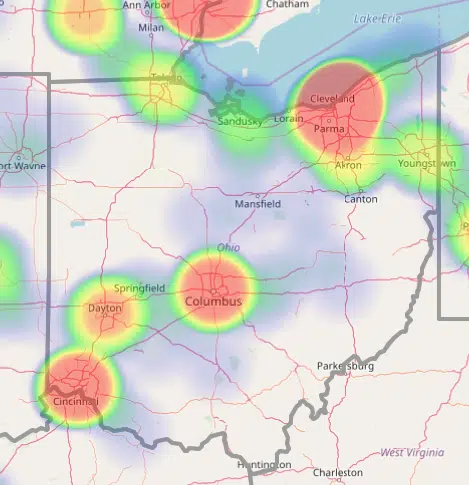

The Ohio Housing Market:

In 2005, The Investor's Edge became the all-in-one solution for anyone looking to break into or further their goals in the real estate investment market.

Our industry-leading software gives first-time investors and successful flippers alike a path to the next step in their projects, and our hard money loans ensure they have the funds to make it happen.

From training to funding to flipping, our team will be there through every step.

Real Estate Investing Loans in Ohio

Hard Cash Loans For Property Investments: The Investor's Edge has been a respected leader in Ohio since 2005, known for issuing low-cost hard money loans to real estate investors. We can help you find a suitable investment property, fund your purchase, and even help you with rehabbing it.

Hard Money Loans for Bad Credit in Ohio: Having bad credit shouldn’t preclude you from flipping houses in Ohio. We issue hard money loans despite bad credit to real estate investors who choose low-risk homes to rehab. Use the BRRR strategy, fix and flip, or look for wholesale homes to become a successful property investor in Ohio.

Your Partner in Ohio Property Investment: The Investor's Edge is about more than issuing hard cash loans to property investors. Especially those new to property investing appreciate how we help them with finding a suitable property, purchasing it, rehabbing it, and selling it for a tidy profit.

The Perfect Ohio Hard Money Loans For You

The Investor's Edge believes every person who wants to achieve financial freedom should have the chance to do so, and we’re ready to help them, regardless of credit score or experience level.

Our equity-based loans allow you to get your start in the industry or come back from a couple of bad flips.

When you come to us with a deal, we want to invest in it — every good deal gets funded.

For many people, putting money down on a home is the main barrier to getting involved with real estate.

We overcome that by offering up to 100% financing with flexible terms customized to fit your needs and goals.

Most of our clients bring a fraction of what they would need with other lenders to close, and they appreciate up to five months free of payment so they can use their money to start their projects.

Benefits of Flipping Houses in Ohio

Ohio is currently one of the hottest states for fix and flip loans.

The state’s property values are lower than the national average, but rising quickly, meaning now is the perfect time to stake your claim and make a major profit.

Act now while it’s an easy market to enter, fix up the property with a loan from The Investor's Edge, and prepare to see your investment come back — and then some.

Once you’ve fixed up a property, you can sell it to an eager buyer for top dollar as the market value increases, giving you a lump sum you can use to fund your next flip property.

Or, you can keep the property through the BRRR or BRRRR method and turn it into a rental, providing you with a new income stream.

Loan Programs For Property Investing in Ohio

More loan programs give you more choices, and at The Investor's Edge, we offer property investors 30 loan programs.

Our hard money lenders match you with the loan program that works best for your situation, making flipping houses in Ohio easier.

Real Estate Investing Training Materials

Not every hard money lender is interested in helping beginner property investors learn the ropes.

But at The Investor's Edge, we provide real estate investing software that helps you with such complex tasks as calculating risk and profit on real estate investments.

What Makes The Investor's Edge Loans Different?

Why Choose The Investor's Edge as Your Ohio Hard Money Lender?

While there are certainly other hard money lenders and training programs, no one offers you both like The Investor's Edge does through our Find-Fund-Flip system.

We want you to have everything you need to make the best investments for your future from the moment you apply for funding.

When you’re approved, we’ll give you 24/7 access to our Investor’s Edge platform, giving you insights into the market through millions of property listings and educational resources.

We’ll also assign you a loan advisor and project manager to ensure you stay on track and can see the results you’re hoping for.

Choose The Investor's Edge

Investors choose us because they see that we want to help you, no matter your situation, succeed at real estate investing. Many come because they are excited about our 100% financing program, but then stay for multiple deals because of our commitment to them.

Between our deal-finding software, low-barrier funding, and dedicated team members, you won’t find another lender who makes it easier to find and close profitable deals, period.