Hard Money Loans in New Jersey

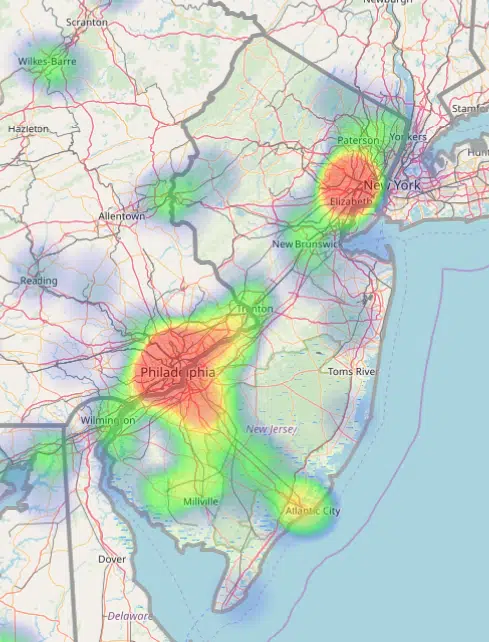

The New Jersey Housing Market:

When it comes to real estate, New Jersey is one of the top markets in the country, full of desirable landscapes and incredible property listings.

Whether you’re new to flipping or a seasoned professional, finding the right project for your next investment requires some insider knowledge and secure financing options.

Luckily for you, The Investor's Edge can help you on both fronts.

Get Hard Money Financing Fast For New Jersey Properties

Low Cash-To-Close Loans: The Investor's Edge has been providing hard money loans to New Jersey real estate investors since 2005.

We are a preferred private lender financing off-market purchases in Newark, East Orange and Atlantic City.

We work with property investors looking for low cash-to-close deals.

Providing Hard Money Loans for Bad Credit: At The Investor's Edge, we issue hard cash loans even if you have bad credit or no experience flipping houses.

We’ll teach you how to flip a house in New Jersey — it’s part of how we do business as hard loan lenders.

Partners in Your Fix and Flip: When we agree to finance your fix and flip project, we don’t just issue you a hard money loan — we can help you with financing your investment property’s rehab as well.

We even teach our members about the BRRR method and wholesaling — in addition to fix and flips.

Hard Money Loans Designed for New Jersey Markets

The Investor's Edge hard money loans can make even the most challenging markets easier to enter, regardless of your experience level or financial situation.

We believe every person should have the chance at financial freedom, as long as they’re willing to put in the work.

We offer up to 100% financing on great deals, creating personalized funding options to fit your needs.

Once your loan goes through, you’ll have the first five months of the loan term to focus on your project before starting repayment.

From fix and flip loans allowing you to make an immense profit to the BRRR method providing you with a new stream of income, The Investor's Edge is sure to put you on the path to financial security.

Why Flip Houses in New Jersey?

New Jersey is home to numerous high-value properties, making it a flipper’s paradise for those seeking the highest revenue potential.

While many homes in NJ require more money upfront (or in our case, larger hard money loans), this can be greatly beneficial.

It results in less competition when placing an offer and more profits once you’re ready to pass the house on.

If you’re considering breaking into the New Jersey housing market, now’s the best time to do so.

Home values have been consistently appreciating, allowing you to get a good deal now and sell later for an even better one.

Combined with various marketable amenities like beachfront properties and diverse local cultures, you can easily find a property (or a few) in an area you love that will sell for a good deal.

Loan Programs For Flipping Houses

Our 30-plus loan programs are targeted to property investors looking to maximize profits, minimize loan costs, reduce cash to close and other varying needs.

Other hard money lenders only offer a few loan programs — we give you more options.

Practical Real Estate Investing Software

We provide our clients with real estate investing software that helps them calculate risk when deciding which homes to buy — a critical tool in developing strategies for flipping homes in New Jersey.

What Makes The Investor's Edge Loans Different?

Why Choose The Investor's Edge?

Even though the overall housing market in New Jersey is expensive, The Investor's Edge knows how to help you find the best deals available through our Find-Fund-Flip system.

Partnering with us for your hard money loans gives you access to so much more than extensive financing.

Every one of our clients also has their own loan advisor and project manager to keep their flip on track.

And perhaps the most crucial tool in our arsenal is the Investor’s Edge deal finding software.

The Investor’s Edge platform has it all, from resources to enhance your knowledge of fix and flip loans in New Jersey to real-time updates on property availability near you.

Experience market research like never before with access to millions of property records and skip tracing that allows you to connect with most property owners around the country.

With a few clicks, you’ll have all the information you need to determine the most potentially profitable properties around.

Choose The Investor's Edge

Investors choose us because they see that we want to help you, no matter your situation, succeed at real estate investing. Many come because they are excited about our 100% financing program, but then stay for multiple deals because of our commitment to them.

Between our deal-finding software, low-barrier funding, and dedicated team members, you won’t find another lender who makes it easier to find and close profitable deals, period.