Hard Money Loans in Missouri

The Missouri Housing Market:

Fixing and flipping houses can be a lucrative real estate investment for your future when done well.

Before you start, you need knowledge and funding, and even after gaining experience, you know there’s always something new to learn to stay up to date in the industry.

The Investor's Edge offers solutions for newcomers and professional flippers alike through our hard money loans, tools, and industry knowledge.

No other lender in Missouri or beyond can provide you with the same level of support in your endeavors.

Real Estate Investing in Missouri

Fix and Flip Loans for Little Money Down: Many private lending companies want 20%-30% down on a hard cash loan. At The Investor's Edge, we provide financing for select real estate investments up to 100%. Keep more cash in your pocket while you’re rehabbing your Missouri investment property.

Missouri Hard Money Loans for Bad Credit: Bad credit shouldn’t stop you from investing wisely. The Investor's Edge issues hard money loans for bad credit for qualifying properties. Your property investment is your collateral, so we won’t dig into your previous repayment history.

Partner with us to Flip Houses in Missouri: When you’re looking for hard money financing to flip houses in Missouri, The Investor's Edge is your best bet. We’re your partner in house flipping, providing not just hard cash loans, but also advice and guidance for BRRR, wholesale real estate investing, rehabbing, selling, and good ol’ fix and flips.

Missouri Hard Money Funding With You in Mind

At The Investor's Edge, every good deal gets funded. We work with people of any experience level and in any financial situation, forgoing credit checks and other barriers similar lenders may require. We create personalized, flexible terms for every loan, offering financing up to 100% of the necessary amount.

Many of our clients close with little or no money down yet still reach unbelievable success by the end of their flip. Furthermore, we don’t require payments for the first five months of your loan term, allowing you to get down to business right away.

Loan Programs For Property Investors - The Investor's Edge offers more loan programs than other private money lenders — more than 30. That helps us serve our clients better, by matching them with the best loan program in Missouri for their needs.

Real Estate Investing Strategies for Beginners - Flipping houses is a great way to make money fast, but you have to be careful. Mistakes can cost you thousands. The Investor's Edge helps those new to property investing by providing real estate investing software, advice, and other tools to teach you the tricks of the trade.

Why Flip Houses in Missouri?

As one of the most affordable housing markets in the United States, Missouri boasts numerous benefits for buyers and sellers alike.

Even as home values within the state steadily appreciate, interest rates have remained low, driving the market’s success by keeping housing prices more affordable in the long run.

Investing in the BRRR method or a fix and flip loan in Missouri allows you easy entry into the local market, whether this is your first flip ever or your first one in the area.

The low housing costs enable you to get great deals on properties, modernize the properties, and return them to market with a high possibility of gaining incredible profit margins upon selling the property or renting it out to eager tenants.

The Investor's Edge Helps Missouri Users Find Their Next Deal

Once you’re approved for our funding, you can begin experiencing the best of what The Investor's Edge offers — benefits other lenders simply won’t have that enable our house flippers to make an average profit of nearly $40,000!

We do this by assigning every flipper their own project manager and loan advisor — however experienced you already may be — for support and guidance throughout every step of the process.

Perhaps our most valuable asset is the Investor’s Edge software.

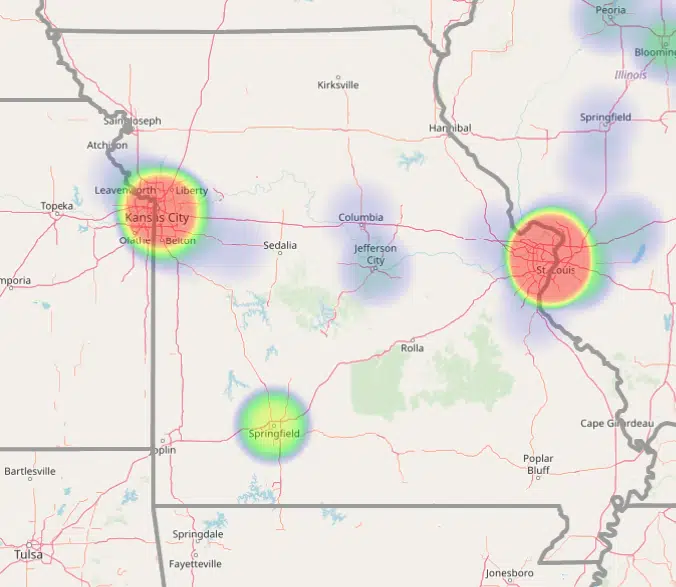

The Investor’s Edge is our industry-leading software that helps you learn more about the flipping industry and determine the most potentially profitable properties in Missouri.

With it, you’ll have access to millions of property records and even skip tracing so you can connect with property owners everywhere.

Between our invaluable educational resources and real estate investment information, any hard money loans we offer are sure to provide a path to success.

Learn About Property Investing in Missouri

No experience in real estate investing?

No problem.

At The Investor's Edge, we give our members resources for each step of the process, including training videos, software, downloads, and even team members assigned to help you.

It’s why we’re successful at real estate investing in Missouri.

What Makes The Investor's Edge Loans Different?

Why Choose The Investor's Edge?

At The Investor's Edge, we want to invest in our clients.

When you bring us a good deal, we’re ready to fund it.

Even if this is your first time flipping homes, we’ll take a chance with you — no upfront costs or credit score requirements.

Many of our clients have been rejected by other lenders or have little to no money to put into a down payment, but we help them get their property and the information they need to make the flip of their dreams.

We do more than your average lender.

Along with helping you secure funding, we’ll give you access to our Find-Fund-Flip System.

This online software provides training in the basics of property flipping and incorporates our Investor’s Edge deal finding platform, which hosts millions of prime flipping properties around the country.

Every client we bring on also gets an assigned loan advisor and project manager to help them flip faster and make a better profit.

Choose The Investor's Edge

Investors choose us because they see that we want to help you, no matter your situation, succeed at real estate investing. Many come because they are excited about our 100% financing program, but then stay for multiple deals because of our commitment to them.

Between our deal-finding software, low-barrier funding, and dedicated team members, you won’t find another lender who makes it easier to find and close profitable deals, period.