Hard Money Loans in Michigan

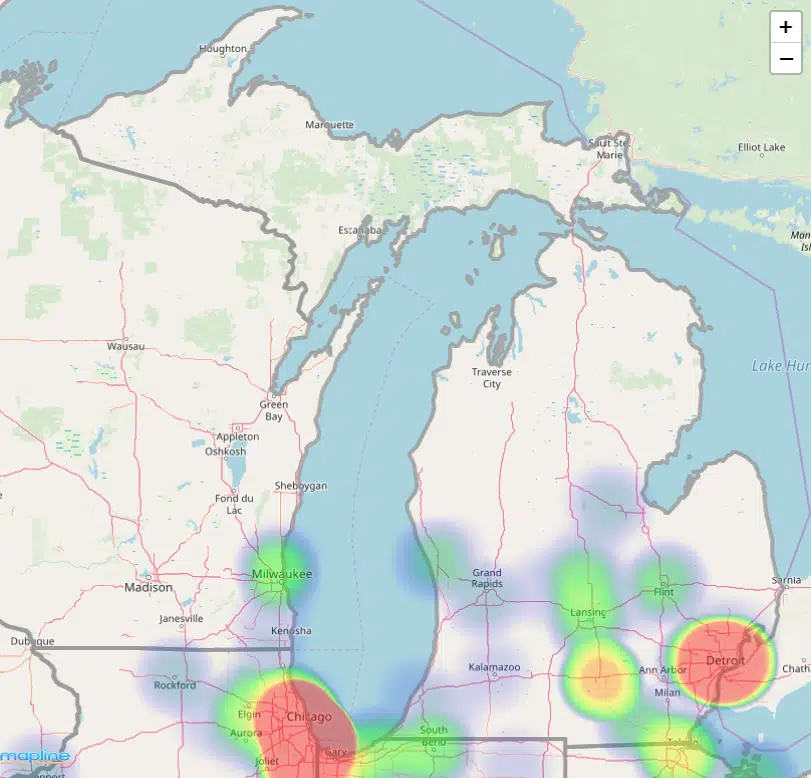

The Michigan Housing Market:

The Investor's Edge is your hard money lender and Michigan real estate guide.

Whether this is your first time flipping or you’re a seasoned pro, we want to provide the support you need to learn about the local market, invest in it, and turn a profit.

Between our advanced knowledge of the market, industry-leading software, and funding options suited to every financial situation, we can empower anyone on their path to financial freedom.

Fix and Flip Loans in Michigan

Buy an Investment Property For Little Money Down: If you’re having trouble coming up with the down payment for an investment property in Michigan that you plan to fix and flip, The Investor's Edge can help. We make hard cash loans for qualifying properties for little or even no money down.

Hard Money Loans For Bad Credit in Michigan: Hard money loans for bad credit can be hard to find. At The Investor's Edge, we don’t weigh your credit score heavily when we facilitate your hard money loan — your investment property serves as your collateral.

Partner with us To Fix and Flip: We aren’t just a private money lender — we’re your partner in flipping houses in Michigan. We not only provide the funding you need for your real estate investment, but we also provide guidance and assistance with with every step of the fix and flip process.

Up To 100% Financing For Flipping Homes

When you can get 100% financing for your Michigan fix and flip, you can keep more money in your pocket while you rehab your investment property. If your property doesn’t qualify for 100% financing, we can show you how to raise the money you need.

Loan Programs For Real Estate Investing - Don’t settle for only a few choices of loan programs for your investment property project. Come to The Investor's Edge, where we offer more than 30 loan programs targeted to your needs. We make flipping houses in Michigan easier for investors.

Learn Real Estate Investing Strategies - The Investor's Edge is more than just a private lending company — we help you become a savvy property investor. We teach you about the BRRR method, wholesale real estate investing, and, of course, fix and flips.

Why Flip Houses in Michigan?

Michigan is one of the top places for making real estate investments right now.

Even with increasing appreciation, home values in many places are well below the national average, costing you less to invest and less to flip.

This advantage is an excellent combination with the expanding job market.

People are flocking to Michigan to find new work, particularly in the education sector, and want to close on a home quickly, especially when they’re bringing their family with them or hoping to start their own once they arrive.

Flipping a house means you’re doing a lot of the renovation work for interested buyers, which is a major benefit to many buyers who want move-in-ready homes.

They’re willing to pay more to do less, so you have the potential to make back your investment and so much more if you do the work.

Why Choose The Investor's Edge?

At The Investor's Edge, we think everyone should have the chance to gain financial freedom.

That’s why we created the most comprehensive fix and flip system.

Our hard money lender services are complete with educational resources, on-demand training, and top-tier software that allows you to learn the basics and start selling fast.

We offer up to 100% financing with zero or low cash-to-close options, even if other lenders have rejected you in the past.

We’ve helped flippers in every situation, whether they want to buy, flip, and sell, or keep the property to rent with a BRRR deal.

We’re more than just a lender. With our resources by your side, you don’t need any experience in the industry to get started.

We assign project managers and loan advisors to each client to assist you in managing your finances and keeping you on track to meet your goals.

Our team wants you to have a successful flip every time and gain life-changing profits through our services.

Choose The Investor's Edge

Investors choose us because they see that we want to help you, no matter your situation, succeed at real estate investing. Many come because they are excited about our 100% financing program, but then stay for multiple deals because of our commitment to them.

Between our deal-finding software, low-barrier funding, and dedicated team members, you won’t find another lender who makes it easier to find and close profitable deals, period.