Hard Money Loans in Maryland

The Maryland Housing Market:

Industry-specific knowledge, on-demand training and incredible selling software — The Investor's Edge is more than your hard money lender.

From funding to education and beyond, our team is ready to help you flip your first or hundredth house and make a huge profit while doing so.

With the right lender on your side, you can secure the perfect property to flip with zero to low cash-to-close and put you on your way to financial freedom.

How To Flip A House In Maryland

Real Estate Investing For Little Money Down: Many more people would try real estate investing if they could get funding for a down payment. At The Investor's Edge, investors who have chosen qualifying homes can get a hard cash loan to flip a house with little or no money down.

Get Hard Money Loans For Bad Credit: It can be hard to get a loan with bad credit, but not at The Investor's Edge. When you come to us for a private money loan, your investment property is your collateral, so your credit score isn’t a factor in our decision to lend you money.

We're Your Partner in Flipping Homes: Lending money can be risky — that’s why we do so much more than provide hard cash loans at The Investor's Edge. We help you with rehabbing, finding contractors, selling the home after rehab and more. Rely on our Find-Fund-Flip System for solid real estate investing strategies.

Hard Money Loans Funded at 100%

The Investor's Edge can lend up to 100% of your deal — and not just the property purchase but the closing costs and rehab too. Not every investment property qualifies for 100% funding; if yours doesn’t, we can show you how to get the money you need.

Loan Programs For Wholesale Home Purchases - Our hard money financing company offers more than 30 loan programs for real estate investing. You can prioritize low down payments, high profits, or low interest rates. The Investor's Edge gives you more choices than other private lending companies.

Real Estate Investing Training - With other private lending companies, once you get the money you need, you’re on your own. With The Investor's Edge, we provide assistance with rehabbing, closing deals, and finding profitable properties through our Find-Fund-Flip System.

Why Flip Houses in Maryland?

Over the years, Maryland has consistently proven one of the best states for flipping homes.

Baltimore is one of the top five cities in the U.S. for house flipping, thanks to its high revenue potential.

Maryland residents have a high median income and are willing to pay more for a beautifully renovated home.

The availability of older homes all over the state makes it an ideal location for long-time flippers and those looking to try their hand for the first time.

With The Investor's Edge on your side, you have the chance to fix, flip, and sell for a one-time profit or fix, flip, and rent out your property through the BRRR process, creating a new stream of income you can maintain for a long time to come.

We’ve helped real estate investors, contractors, interior designers, and people new to the real estate industry secure their financial futures by investing in the Maryland market.

Top 10 Maryland House Flipping Markets

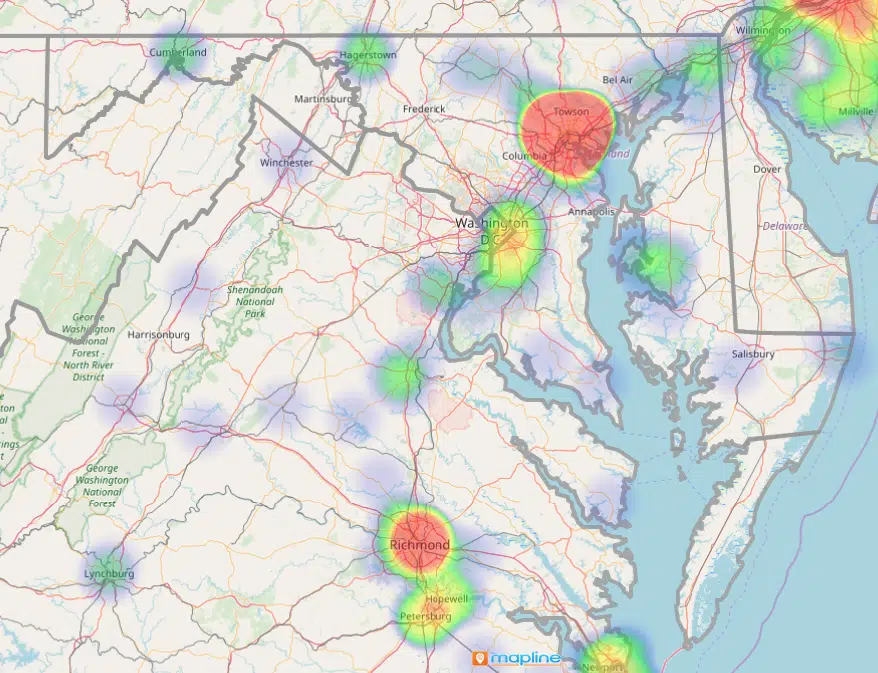

Our heatmaps show where the best investment properties for sale are in Maryland.

We aren’t just private money lenders; we provide tools and real estate investing software to help you succeed in your new venture as a property investor.

- Baltimore

- Cumberland

- Capitol Heights

- Fort Washington

- Hagerstown

- Temple Hills

- Upper Marlboro

- Easton

- Glen Burnie

- Elkton

What Makes The Investor's Edge Loans Different?

Why Choose The Investor's Edge?

At The Investor's Edge, we want to invest in our clients.

When you bring us a good deal, we’re ready to fund it.

Even if this is your first time flipping homes, we’ll take a chance with you — no upfront costs or credit score requirements.

Many of our clients have been rejected by other lenders or have little to no money to put into a down payment, but we help them get their property and the information they need to make the flip of their dreams.

We do more than your average lender.

Along with helping you secure funding, we’ll give you access to our Find-Fund-Flip System.

This online software provides training in the basics of property flipping and incorporates our Investor’s Edge deal finding platform, which hosts millions of prime flipping properties around the country.

Every client we bring on also gets an assigned loan advisor and project manager to help them flip faster and make a better profit.

Choose The Investor's Edge

Investors choose us because they see that we want to help you, no matter your situation, succeed at real estate investing. Many come because they are excited about our 100% financing program, but then stay for multiple deals because of our commitment to them.

Between our deal-finding software, low-barrier funding, and dedicated team members, you won’t find another lender who makes it easier to find and close profitable deals, period.