Hard Money Loans in Louisiana

The Louisiana Housing Market:

Now is the time to secure your financial future — if you’re ready to put in the work.

The Investor's Edge is your team of hard money lenders and real estate experts, providing you with the education and information you need to invest in your own future.

We equip you with tools like industry-leading software and knowledge based on years of experience to offer the most complete lending services available.

When you need a fix and flip loan for a Louisiana property, ensure you work with the real estate investors that empower you to reach your potential.

Whether this is your first time flipping a home or you’re a professional, our services will help you procure your next flip more easily and sell faster than ever.

Why Flip Houses in Louisiana?

Getting involved in the flipping market can be a breeze when you know where to go.

At The Investor's Edge, we suggest a location like Louisiana due to its low housing costs.

While there’s no shortage of people looking to move to the area, most want to purchase a move-in-ready property instead of spending time renovating and fixing it up.

This niche is where you come in.

Effective flippers find a property for cheap, fix it up, and sell it for an incredible profit.

If you manage this return on your investment, you can use that profit to take the next step in your life or purchase your next fixer-upper.

However, even if the property is comparatively inexpensive, you might need a loan to secure it — this is where we come in!

Reliable, Fast Funding For Single Family Homes In Louisiana

Lowest Cash-To-Close - We’ve been the premier lender for hard money in Louisiana since 2005. We pride ourselves on providing loans that are a good fit for your needs, getting you the cash quickly to start work on your project, and then providing individual support throughout the rehab and resell process.

No Credit or Experience - As a hard money lender, we are less concerned with factors such as credit score and debt-to-income ratio. If you can provide us with a good real estate deal that has the potential for profit, even if you don’t have $30k disposable, we will make it work.

We're On Your Side - We firmly believe in helping you move towards financial security with every interaction you have with us.

True 100% Financing

We will provide loans of up to 100% on property purchase, rehab and costs.

If you don’t qualify for the full amount required for your deal, we’ll teach you how to find the rest.

Our goal is that every good deal gets funded, and that every borrower can complete deals without using their own money if they choose.

Flexible Loan Programs To Match Any Borrower's Goals

Many lenders offer only a couple of loan programs to suit their customers’ needs.

We have 30 available. If you’re looking for the most profit, lowest closing costs, or cheapest loan rates, let us know.

We’ll fit you with the best-matching program according to your current situation.

Industry-Best Risk Mitigation

Our Advanced Deal Analysis software is the first step in helping you decide if your deal makes sense.

Then, our rigorous two-step evaluation process helps all of us be confident in going ahead with your loan.

Then we’ll stay by your side to make sure everything goes smoothly all the way through the rehab process.

Hard Money Loans in Louisiana

We provide each client with a custom video of our analysis and recommendations for their property.

You’ll know exactly which comparables we search, from where those comps come from, and how the values were derived in order to determine your final loan values.

There’s nothing more frustrating than being in the dark about something this important.

Our borrowers’ average profit on a paid-off loan in 2021 was $47,884.

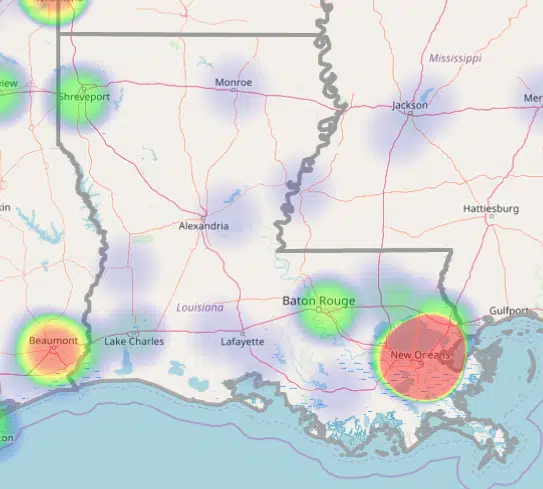

10 Most Popular Cities to Fix-and-Flip in Louisiana

- New Orleans

- Metairie

- Baton Rouge

- Slidell

- Lake Charles

- Shreveport

- Harvey

- Marrero

- Westwego

- Kenner

What Makes The Investor's Edge Loans Different?

Why Choose The Investor's Edge?

As the market currently stands, The Investor's Edge is the most innovative resource as the only one-stop shop for real estate investment loans.

We provide more than just funding for you and your flipping journey.

Our solutions include tools that give you the right information to stay ahead in the market, including these benefits and more:

- Investor’s Edge property records

- Dedicated support resources

- A quick and seamless funding process

- Experienced project managers

All of these resources and tools are all part of our flagship Find Fund System that aims to maximize your earning potential.

With our support, you can turn your hard work into a profit.

Become one of the many people who have used our tried and trusted system and you’ll join them in reporting nothing but success from their journey with our team.

Choose The Investor's Edge

Investors choose us because they see that we want to help you, no matter your situation, succeed at real estate investing. Many come because they are excited about our 100% financing program, but then stay for multiple deals because of our commitment to them.

Between our deal-finding software, low-barrier funding, and dedicated team members, you won’t find another lender who makes it easier to find and close profitable deals, period.