Hard Money Loans in Chicago

Reliable, Fast Funding For Single Family Homes in Chicago

Lowest Cash-To-Close: As the premier hard money lender in Chicago since 2005, we’re your go-to option for getting funds for your next deal. We pride ourselves on working together to find loans that fit your needs, get the cash to you fast, and then help you through the rehab and sale of your finished project.

No Credit or Experience: As a hard money lender, we don’t have as many requirements for the borrower to qualify, which is beneficial for those just starting out. If you bring us a good deal with potential profit, we can make it work even without having significant capital reserves or creditworthiness.

We're On Your Side: We care about your financial security. That will be the goal of every interaction you have with us.

Hard Money Loans in Chicago

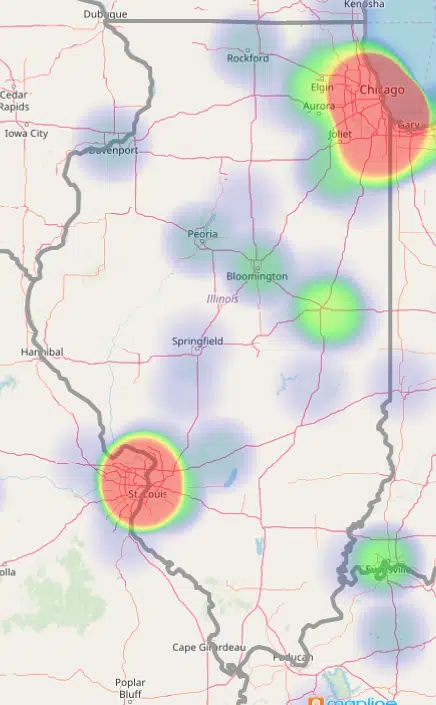

The 10 most popular cities to fix and flip houses in Chicago and the surrounding area:

- Chicago

- South Holland

- Park Forest

- Dolton

- Hazel Crest

- Calumet City

- Chicago Heights

- Markham

- Maywood

- Peoria

What Makes Our Hard Money Loans Different in Chicago?

- No minimum credit score

- No experience required

- Up to 100% financing

- Interest rates beginning at 12%

- Origination as low as 3.5%

- Lend up to 75% ARV

- Loans up to $350K

- No prepayment penalties

- No payments for 5 months

Fewer Barriers For New Investors

The lending system is broken.

With most lenders you’ll need good credit and lots of money to flip houses.

That is why most people who want to get started can’t do it.

That’s not how we work.

We believe that everyone should have the opportunity to build financial security for themselves.

While we lend to experienced investors, a large percentage of our borrowers come to us because we make flipping your first deal possible.

True 100% Financing

We’ll lend up to 100% of your purchase, rehab, and loan costs. I

f your loan won’t quite cover all your costs, we can teach you how to find more money to complete your deal.

Flexible Loan Programs To Match Any Borrower's Goals

Many lenders have a couple of loan programs to fit their borrowers’ needs.

We have 30.

Are you looking for the most profit?

Lowest cash-to-close?

Cheapest loan costs?

You tell us your current situation and your goals, and we’ll find a loan program to match.

Why Choose The Investor's Edge?

The main difference between The Investor's Edge and other money lenders is that with us, you can get every opportunity you need to earn financial independence through house flipping.

If your search for a hard money lender in Atlanta, Georgia, hasn’t been successful so far, we can help.

Here are just a few benefits of working with us:

- Learning tools: You can use our training course and support resources to gain the knowledge you need to become a professional house flipper in no time.

- Supportive helpers: Your dedicated loan advisor and project manager from The Investor's Edge offer support on your way to achieving your real estate goals.

- The Investor’s Edge: You can leverage this software to locate the best properties in the market you serve.

- Access to resources: Your one-time payment gives you access to anything you need for house flipping, including training, software, and funding.

Choose The Investor's Edge

Investors choose us because they see that we want to help you, no matter your situation, succeed at real estate investing. Many come because they are excited about our 100% financing program, but then stay for multiple deals because of our commitment to them.

Between our deal-finding software, low-barrier funding, and dedicated team members, you won’t find another lender who makes it easier to find and close profitable deals, period.