Hard Money Loans in Illinois

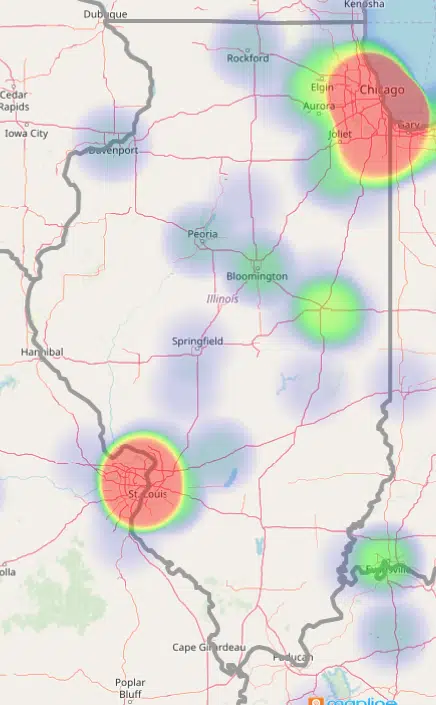

The Illinois Housing Market:

Advanced market knowledge, comprehensive flipping software, and funding options for every budget — The Investor's Edge empowers you to find your path to financial freedom.

Flipping houses in a place like Illinois can be highly lucrative when you have the right help, giving you the resources to form your future decisions or fund your next investment.

Our hard money loans and expert guidance have given hundreds of people like you the opportunity to enter the flipping market for the first time or enhance the services they offer.

Get Funding For Real Estate Investments in Illinois

Fix and Flip For Little Money Down - Scraping together a down payment is arguably the hardest part of real estate investing. At The Investor's Edge, we fund hard cash loans for little or even no money down. While only great deals qualify, we can teach you to find other sources of funding for the ones that don’t.

Hard Money Loans For Bad Credit in Illinois – Having bad credit can mean fewer opportunities, but not with The Investor's Edge. Your property investment is your collateral, so we don’t set a minimum credit score requirement. Once you learn to fix and flip homes in Illinois, you’ll never worry about bad credit again.

We're Your Partner in Property Investment – We’re a different breed of hard lenders. We consider ourselves your partner in property investment, providing not only the hard cash loans you need, but also guidance and assistance with closing costs, home rehab, and more.

Get 100% Financing From Our Hard Money Lenders

Most hard cash loans require 20%-30% down.

The Investor's Edge will provide up to 100% financing for qualifying investment properties in Illinois.

If the wholesale property you chose doesn’t qualify for 100%, we can show you how to get the rest of the money you need.

Loan Programs For Fix And Flips

Unlike other hard money lenders that offer only a few loan programs, The Investor's Edge offers 30.

We match you with the best hard cash loan for your requirements.

Do you need to make a low down payment?

Or is a low interest rate more important?

We can help.

Real Estate Investing Training

If you’re new to the fix-and-flip game, take advantage of our real estate investment training opportunities with our Find-Fund-Flip System.

We provide real estate investing software to help you find investment properties in Illinois, calculate profit margin and determine other critical aspects of property investing.

What Makes The Investor's Edge Loans Different?

Why Flip Houses in Illinois?

Currently, Illinois is a seller’s paradise market. Like many areas around the country, demand is outpacing supply, and as people move into the area for new jobs and life experiences, they want a home that’s ready for them to move into right away.

Flippers like you can meet that need by buying up cheap, fixer-upper properties and transforming them into a home that fetches top profits.

Our team will equip you with the funds and knowledge you need to do so.

Whether you want to buy, flip, and sell or buy, flip, and rent, The Investor's Edge offers fix and flip loans to satisfy your needs.

Why Choose The Investor's Edge?

The main difference between The Investor's Edge and other money lenders is that with us, you can get every opportunity you need to earn financial independence through house flipping.

If your search for a hard money lender in Atlanta, Georgia, hasn’t been successful so far, we can help.

Here are just a few benefits of working with us:

- Learning tools: You can use our training course and support resources to gain the knowledge you need to become a professional house flipper in no time.

- Supportive helpers: Your dedicated loan advisor and project manager from The Investor's Edge offer support on your way to achieving your real estate goals.

- The Investor’s Edge: You can leverage this software to locate the best properties in the market you serve.

- Access to resources: Your one-time payment gives you access to anything you need for house flipping, including training, software, and funding.

Choose The Investor's Edge

Investors choose us because they see that we want to help you, no matter your situation, succeed at real estate investing. Many come because they are excited about our 100% financing program, but then stay for multiple deals because of our commitment to them.

Between our deal-finding software, low-barrier funding, and dedicated team members, you won’t find another lender who makes it easier to find and close profitable deals, period.