Hard Money Loans in Georgia

The Georgia Housing Market:

House flipping offers incredible profit opportunities in real estate as long as you have the right partner.

If you’re struggling to find a hard money lender in Georgia willing to work with you, The Investor's Edge can help.

We offer the financing you need, regardless of whether you’re doing your first flip or have been flipping for years.

As a house flipper, you want to get money quickly so you can complete flips and make a profit.

The Investor's Edge offers convenient access to the funds you need for any real estate investment project.

Hard Money Loans Perfect for Georgia House Flippers

If you are a house flipper in Georgia, hard money loans are the best way to finance your flipping project. Here are some reasons to consider going to a hard money lender for a loan:

No Upfront Fees For Loan Applications – Some loans require you to pay a fee before you get the loan, but hard money loans do not.

Fast Approval and Funds – The approval process for this type of loan is brief, with approval as little as a day and funds just days later.

Case-By-Case Terms – Hard money loans often have flexible terms, so you can find an offering with repayment terms that will fit your needs.

What Makes The Investor's Edge Loans Different?

Hard Money Lenders Providing Up To 100%

Some property investments in Georgia qualify for 100% financing from The Investor's Edge.

If your chosen property doesn’t qualify, we’ll show you ways to get the hard cash you need for your down payment.

Don’t let anything stand in your way of flipping your first house.

Loan Programs For Flipping Houses

We offer more than 30 choices for hard money loan programs in Georgia.

Whether you’re looking for a low down payment, low interest rate or the highest profit margin, it’s our goal to help you find the best hard loan for you and your specific situation.

Real Estate Investing Strategies

The Investor's Edge provides real estate investing software to help new and inexperienced property investors learn the ropes to fixing and flipping houses.

It helps you calculate risk, allowing you to choose and move forward with only the best deals.

Reasons To Flip Houses in Georgia

Georgia offers many opportunities for those looking to get into house flipping or other forms of real estate investment.

Consider the following benefits of flipping houses in Georgia:

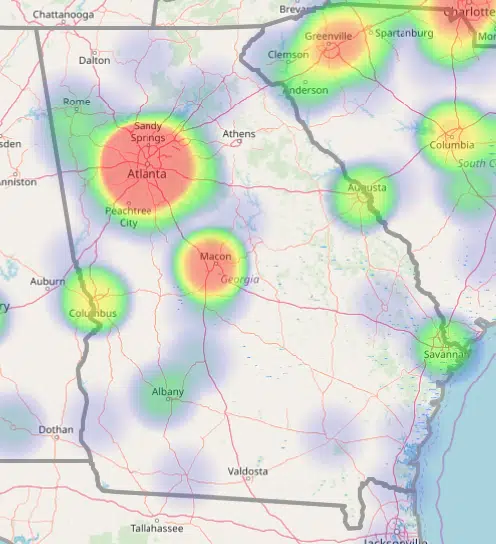

- Thriving cities: Atlanta, Columbus, Savannah, Gainesville, and Marietta offer hot markets where you can profit from buying and reselling properties.

- Healthy economy: As a Georgia house flipper, you can benefit from having many potential buyers due to the state’s low unemployment and large labor force.

- Low-cost housing market: You can get started with less money by buying houses at lower prices and flipping them for profit.

- High demand: In the current seller’s market, you can find buyers more quickly for your flipped properties.

Why Get Hard Money Loans From The Investor's Edge?

The main difference between The Investor's Edge and other money lenders is that with us, you can get every opportunity you need to earn financial independence through house flipping.

If your search for a hard money lender in Atlanta, Georgia, hasn’t been successful so far, we can help.

Here are just a few benefits of working with us:

- Learning tools: You can use our training course and support resources to gain the knowledge you need to become a professional house flipper in no time.

- Supportive helpers: Your dedicated loan advisor and project manager from The Investor's Edge offer support on your way to achieving your real estate goals.

- The Investor’s Edge: You can leverage this software to locate the best properties in the market you serve.

- Access to resources: Your one-time payment gives you access to anything you need for house flipping, including training, software, and funding.

Choose The Investor's Edge

Investors choose us because they see that we want to help you, no matter your situation, succeed at real estate investing. Many come because they are excited about our 100% financing program, but then stay for multiple deals because of our commitment to them.

Between our deal-finding software, low-barrier funding, and dedicated team members, you won’t find another lender who makes it easier to find and close profitable deals, period.