Hard Money Loans in Alabama

The Alabama Housing Market:

Get a taste of the house flipping and real estate investment life with hard money from The Investor's Edge.

Our specialized software will help you turn significant profits and learn more about how to conduct business with contractors and buyers.

Tackle the Alabama housing market without worrying about repayments and lengthy loan processes.

Get Hard Cash Loans Quickly To Buy Investment Properties in Alabama:

Fix and Flip for Little Down – The Investor's Edge has been a preferred Alabama hard lender since 2005. We help Alabama real estate investors secure hard money financing to purchase and rehab off-market homes in Birmingham, Huntsville, Montgomery, and other in-demand Alabama cities. Rely on a trusted private money lender to help you obtain loans for flipping houses.

Hard Money Loans for Bad Credit – As a hard money lender for Alabama property investors, we do not require applicants for hard cash loans to have a good credit score. Your credit history is separate from a real estate investment deal because the investment property you want to buy will serve as collateral for your hard loan. Start flipping homes today—no experience required.

Fix and Flip Partners – As a private lender, we are on your side. We are here to help you find a great deal, get funding for that deal, fix it up and sell it for a healthy profit. When you win, we win.

Hard Money Financing - 100%

Select property investment deals in Alabama can qualify for up to 100% financing, which includes money for closing costs and home rehab.

If you don’t qualify, we can show you how to get the money you need.

Fix and Flip Loan Programs

The Investor's Edge is dedicated to helping you find the best loan program for flipping houses in Alabama.

We offer 30 loan programs that address profits, loan costs, cash to close and more.

Real Estate Investing Software

As part of our Find-Fund-Flip System, our real estate investing software helps you calculate risk in each of your property investment deals in Alabama.

Each fix and flip you do is different — you want to move ahead only when you have the best chance of success.

Why Flip Houses in Alabama?

Alabama is an attractive state for first-time and experienced flippers alike.

The state’s foreclosure rate is higher than the national average, giving you access to more properties below market value.

If you want a lower-risk environment for a house flip, these conditions are ideal.

You can spend less on Alabama properties, flip them into valuable properties and sell them for a higher profit.

Many cities in Alabama are filled with promise thanks to some of the best figures for real estate investors.

You can check out several cities with great figures, including Birmingham, Huntsville, Montgomery, Mobile and Irondale.

Find The Best Alabama House Flipping Markets:

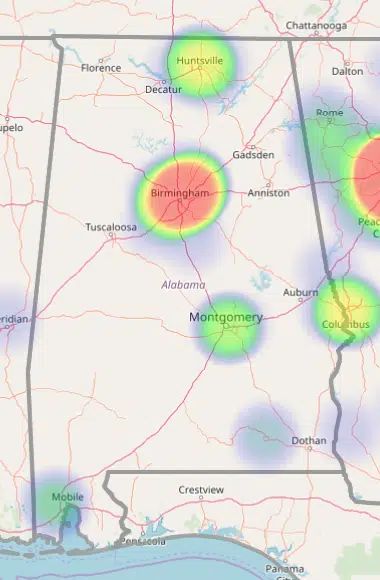

Our heatmaps help property investors find the best deals on homes for sale in Alabama. We provide real estate investment information such as property values in the area, estimated value per square foot, one-year price growth and more. This data helps real estate investors pinpoint the best areas for flipping houses and more accurately determine how much money they can make on any given deal.

- Birmingham

- Huntsville

- Montgomery

- Mobile

- Irondale

- La Fayette

- Enterprise

- Adamsville

- Center Point

- McCalla

Why Choose The Investor's Edge?

We’re a source of funding that is entirely on your side and we want to help you with every step of the flipping journey, from funding to selling. Our system offers you everything you need to succeed in the competitive market, including:

- Training.

- Fully-functional software.

- Financial solutions.

- Flagship funding.

- Advice and proof of funds.

- Dedicated support.

Our system makes it easy to follow all the important steps necessary to flip houses successfully. We have project managers, loan advisors and resources to guide you through every phase of the process.

Experienced and new flippers have found success through our software and achieved the profits they wanted with our process. With information readily available, we’ll give you access without unnecessary credit score screening processes so you can get started as soon as we approve you.

Investors who use our system work hard — and in return, they receive real results that they are happy to share with anyone else who wants a chance at achieving their own flipping goals. Our team at The Investor's Edge wants to ensure you have the opportunity to gather the right information, confidently face the market and walk out the other side with your earnings!

Loan Rates and Details:

Choose The Investor's Edge

Investors choose us because they see that we want to help you, no matter your situation, succeed at real estate investing. Many come because they are excited about our 100% financing program, but then stay for multiple deals because of our commitment to them.

Between our deal-finding software, low-barrier funding, and dedicated team members, you won’t find another lender who makes it easier to find and close profitable deals, period.