Land Flipping is a fantastic way to do real estate with fewer headaches, yet still bringing in good profit.

Most real estate investors don’t typically think about raw land when it comes to turning a profit. Their focus is generally more on fix & flips or owning rental properties.

Land flipping is when an investor buys an undeveloped piece of land, and then resells it at a higher price. The investor can make improvements to the property, but it’s common to resell the land without doing any work on it.

Learn the 10 Reasons Why Land Flipping is a Great Way To Make Money In Real Estate. Watch below:

Summary

What is Land Flipping?

Despite being a full-time real estate investor for over 20 years, and having done 400+ fix & flips, I didn't really understand land flipping.

I'd always considered it a liability as it doesn't produce any sort of cash flow, but it still carries costs, such as taxes.

However, in the past few years, I've done a bunch of land deals, and I think it's one of the best investment strategies out there now.

Land flipping often falls under the radar for a few reasons:

- Lack of an HGTV spotlight - there isn't a fun "before and after" when it's just dirt.

- Less profit than a Fix & Flip - the ROI (Return on Investment) is incredible on land deals, but in general fix and flip deals have had more profit.

- Most people have some understanding of residential real estate...but few have ever dealt with raw land.

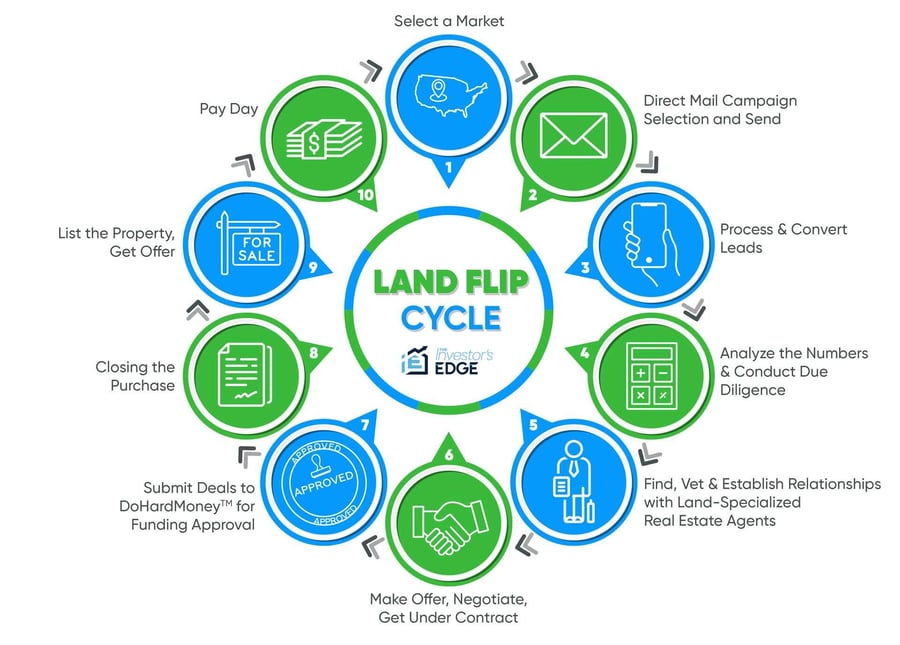

How Does Land Flipping Work?

Here are the main steps of a land flip so you can get a feel for how it goes:

- Select a Market/Market Research - Research state and local laws around land flipping. See if the market factors are conducive to profitable land flips.

- Direct Mail/Send Postcards - Put together a list, filter & sort the list, then load it into a direct mail service provider.

- Process & Convert leads - Have calls go to a pre-recorded voicemail that is not your cell phone. Only call back the interested ones.

- Analyze the Numbers & Conduct Due Diligence - Once you know that they are interested in selling their piece of land you want to make sure it is still a good deal.

- Make offer, Negotiate, and get the Property Under Contract – You will work with the land owner to negotiate a price and get it under contract.

- Find, Vet, & Establish Relationships with Land-Specialized Agents – Once you have the property under contract, you're going to want to find the best land agent in that area to list and sell the property for you.

- Submit the land deal to The Investor's Edge for Funding Approval – We will review the deal to make sure all the numbers line up for us to be able to fund the deal.

- Closing the Purchase – Once you have it under contract and the funding in place, it's time to close on the land.

- List the Property and get Offers - Now that you own the property, you will use your Land-Specialized agent to list your piece of land for sale and start getting offers.

- Closing on the Sale and Getting Paid - You've found a buyer and you sell them the land at retail value. You get paid the profits and repeat the process.

What are the Benefits of Land Flipping?

As I mentioned above, land flipping is now one of my favorite strategies. These days, I've actually been doing more of them than fix and flips. In fact since they're relatively simple to pull off, I've been getting my teenage boys working on deals themselves!

Some of the benefits of land flipping are:

- Good Profit Available - While you're likely to get less profit per deal than a fix & flip, the returns are still amazing. Especially when you consider the total investment required is much smaller.

- No Rehab - That means no dealing with supply costs, contractors, construction deadlines, unexpected costs, and more. The rehab is the #1 reason fix & flip deals fail.

- Smaller Investment - Even low-end fix & flip projects require $100k - $300k for the purchase, rehab, and loan costs. I like land flips in the $25k - $50k range (But you can definitely do much smaller than that if you want.)

- Little Competition - As covered above, few people even know that land flipping is a profitable way to invest. Houses always have a lot of competition, but there's more land and fewer buyers.

- Small Deals and Larger Deals Require the Same Work (Within Reason) – Since there's no rehab, it requires the same effort to flip a larger piece of land as it does a small one. Of course, if it's a million dollar property, you'll have trouble with buyers...but within reason, this point holds.

- Flip Anywhere – I have yet to flip a land deal in Utah, the state where I live.

- Fast – Most of my deals have moved from postcards sent to profit in under 3 months. Usually it takes around 9 to 12 months, but with our system we are able to speed up the process.

- Overall...Less Can Go Wrong! – Overall, there are a lot fewer moving parts than most real estate deals. There's less money involved, meaning less risk. That all means fewer headaches and a higher likelihood of profiting.

What are the Risks of Land Flipping?

While the benefits outweigh the risks (in my opinion), every real estate investment carries some risk.

Here are a few of them:

- Less Established Market (Harder to Sell) - With residential real estate, houses are in high demand. Even in a buyer's market, the seller can lower the price a little and still sell it. It is possible to have zero interest in a piece of land. However, I've been able to sell all my plot of land in a reasonable amount of time.

- Ongoing Costs - Pretty much all real estate carries ongoing costs and land flipping is no exception. These costs are mostly in the form of taxes.

- Active Investment - Finding deals, negotiating, establishing values, and finding & working with a land agent all require active management. It's still less work than managing a contractor for a fix & flip, but more work than if you were funding deals or investing in stocks.

How to Get Funding for Land Flipping?

Of course, the biggest question with any sort of real estate investing is where are you going to get the money for it.

Here are a few of the more common ways to get financing for land flipping deals:

Pay For It Yourself

One of the best parts of land flipping is that it's so much cheaper to get into than most other types of real estate. In fact, I've done deals with incredible ROI that cost me less than $5k for the entire deal.

No outside financing, no borrowing, nothing.

Of course, I also understand not wanting or not being able to fund those types of deals. I also really like to focus on deals that cost $25k+ because with no more effort, you can bring in bigger paydays.

There are a number of ways to pay for a deal yourself without having to pull cash out of your bank account. Here are a few:

- Home Equity Line of Credit - A line of credit with your house as collateral. These typically get you the best rates for a line of credit.

- Pull Equity out of Your House - If you've got equity, you might be able to refinance and start with a nice nest egg for deals.

- Self-Directed Retirement Accounts - If you've got a self-directed 401(k) or IRA account, you can use those funds for real estate. The profits are required to go back into your retirement account, so whether you want to do this will depend on your goals.

- Credit Card Financing - I know...you probably cringed at this, but here me out. There are brokers that can give you cash advances on your credit card. Often you'll pay an origination, but then also get 0% interest for 6-24 month terms.

Private Lender

This type of funding comes from a single individual. You can find people who do this in real estate investment groups (in person or virtually). There are also services on line that help line up private lending with individuals. Simply head on over to Google and type in “private lending in [AREA].”

You will also likely get hard money companies showing up, but that is another great source of funding.

Hard Money

Hard money is basically a more established form of private lending. These are usually companies that have set evaluation processes, personnel to help you, set lending criteria, and established processes for repossessing the property in the event of a default.

Many hard money lenders have areas of focus, such as high value deals or only fix & flips. There are many out there that do fund land deals as well.

The Investor's Edge has it's own course and hard money funding to help you do profitable land deal flips.

Friends & Family

Do you have an aunt or a brother who has some extra money they want invested? Try using an approach such as "I'm working on a real estate deal and I was planning on going to get a loan from a hard money lender. However, before I do, I wanted to see if you'd be interested in funding the deal yourself."

Get Pre-Qualified for 100% Financing on Land Deals Now:

Fill out the application for a free pre-qualification consultation. We will discuss your real estate financial goals, see if our 100% financing is a good fit to help your reach your goals, and then answer your questions. You don't need a land deal to get pre-qualified.