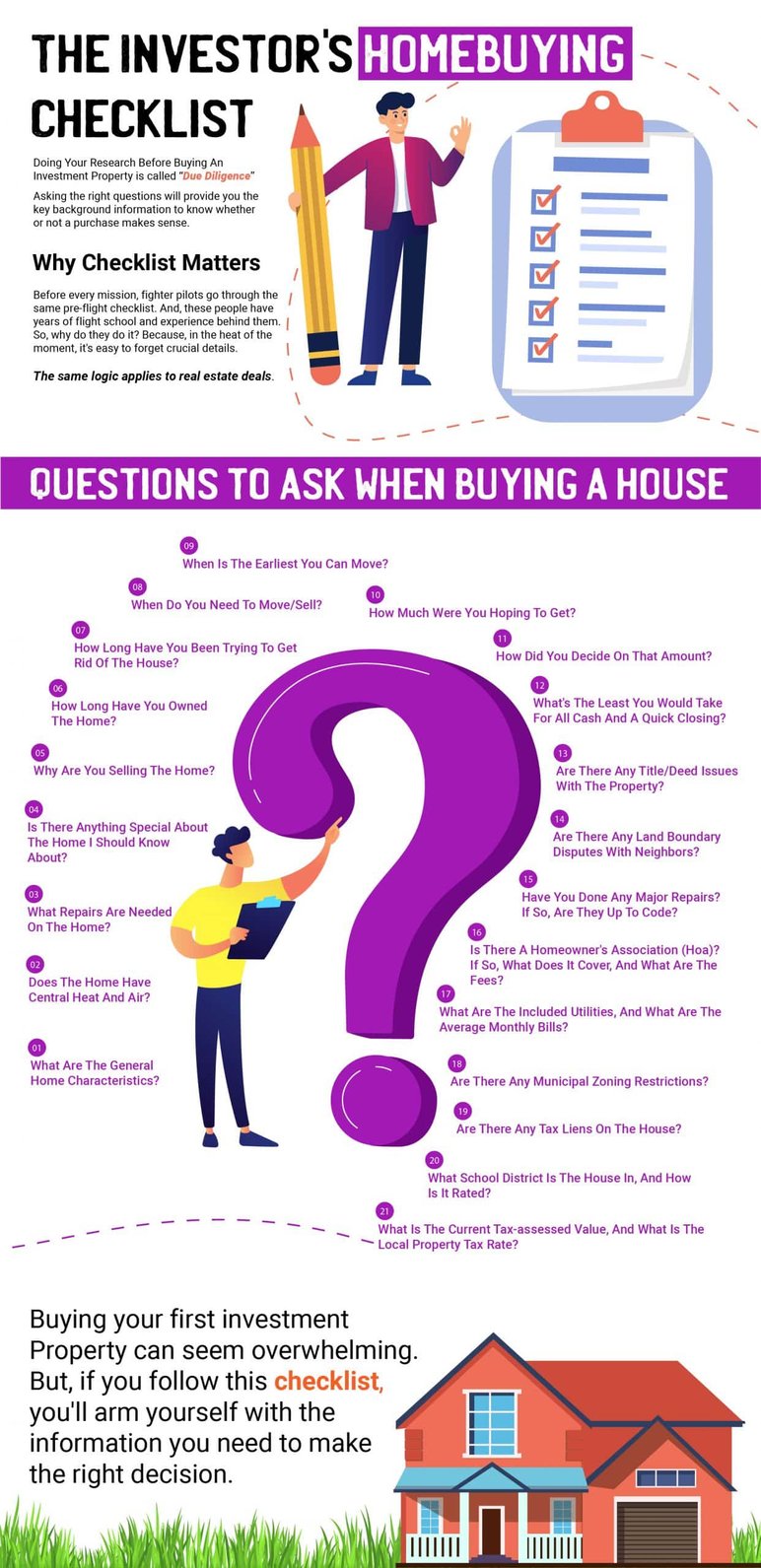

The phrase “due diligence” mystifies many new real estate investors. It shouldn’t! In simple terms, due diligence means doing your research before buying an investment property. Asking the right questions will provide you the key background information to know whether or not a purchase makes sense. As such, I’ll use this article as a complete checklist: the 21 questions investors should ask when buying a house.

Specifically, I’ll dive into the following topics related to buying a house as an investor:

- An Overview of Real Estate Investor Due Diligence

- Why Checklists Matter for Investors When Buying a House

- Complete Checklist: 21 Questions Investors Should Ask When Buying a House

- Real Estate Investor Support from The Investor's Edge

- Final Thoughts

An Overview of Real Estate Investor Due Diligence

“What Do Real Estate Investors Look For?”

Generally speaking, due diligence means investigating the background and condition of a house. Investors want to know about a property’s physical condition, its financial issues (e.g. unpaid property taxes), and its location (e.g. the state of the local market).

In other words, think of due diligence as “doing your homework” before buying a property. Would you buy a car without taking it for a test drive and examining its accident history? Absolutely not. And you shouldn’t think about buying a property – a far larger investment than a car – without doing some in-depth research on the home.

As the above chart illustrates, gross profits and ROI from house flips have dramatically increased since a low during the Great Recession. But, a successful flip depends on finding the right deals. If you don’t do your due diligence before buying a property, a seemingly good deal can become a nightmare pretty quickly.

For example, say the seller has done some DIY improvements. If you don’t confirm that those repairs are up to code, you’ll be on the hook for fixing any code violations before reselling the property – potentially costing tens of thousands of dollars and turning a profitable deal into a loss.

Bottom line, before buying a house, do your due diligence. A little up-front research can save you a lot of back-end headaches.

Why Checklists Matter for Investors When Buying a House

Before every mission, fighter pilots go through the same pre-flight checklist. And, these people have years of flight school and experience behind them. So, why do they do it? Because, in the heat of the moment, it’s easy to forget crucial details.

The same logic applies to real estate deals. Could an experienced investor remember every single due diligence question to ask before buying a home? Maybe, but highly doubtful. For new and experienced investors alike, the excitement and pressure of a deal can easily make you forget things or overlook basic details. Don’t leave this research to chance! Instead, as an investor, checklists provide critical back-up. When you follow a checklist, you know you won’t overlook any details.

It doesn’t matter whether you use the fix & flip, BRRR, or other real estate investing strategies, you should craft a thorough checklist to follow before purchasing a home. That way, as you get into the excitement of a new deal, you’ll have the confidence of knowing that you won’t overlook any critical questions or details.

But, new investors don’t always know the right questions to ask, as this understanding comes from experience. We recognize this reality, and we want to help! The Investor's Edge team has built the below checklist to help new real estate investors. Before buying a house, make sure to ask these questions, and you’ll have a solid understanding of whether or not the purchase makes sense.

21 Questions to Ask When Buying a House – Checklist

As you review the below checklist, you’ll realize that some questions should be answered directly by the owner, while others will require some outside research on your part. The important takeaway is that, regardless of where you get the information, you should answer all of the below questions before buying an investment property.

What are the general home characteristics (e.g. bedrooms, bathrooms, square footage, etc)?

Before buying any home, you’ll want to confirm its general layout and characteristics. As an investor, this information will prove critical to developing accurate comps, both for valuation and rental purposes.

For example, if a home has two bedrooms, one and a half bathrooms, a one-car garage, and is 1,200 square feet, you’ll use that information to determine local rents and values for similar properties. Without this comps data, you cannot reliably analyze a deal, regardless of whether you plan on flipping it or taking a BRRR approach.

Does the home have central heat and air?

Central heat and air – especially in climates experiencing temperature extremes – can make a huge difference in a home. For house flippers, if you buy an old house without central HVAC, you’ll need to closely examine the local renovated homes. If the other rehabbed properties do have central HVAC, you’ll need to install it during your rehab process. Otherwise, your home simply won’t be competitive when you list it for sale. And, this sort of addition can cost tens of thousands of dollars, making this a critical piece of information to consider before buying a home.

What repairs are needed on the home?

Both house flippers and BRRR investors buy properties with the intention of renovating them. But, there’s a huge difference between “sprucing up” a place and needing to repair damaged foundations, holes in the roof, busted plumbing, etc. These major repairs can cost a ton of money, and before moving forward with a deal, investors need to account for these repair costs in the deal analysis.

Of note, I recommend asking the homeowner about this info. But, you’ll still need to verify repairs with an in-depth walkthrough with your general contractor. At a minimum, you should hire a professional home inspector to confirm major repair needs. However, home inspectors typically don’t look beneath the surface, so they may not pick up on structural, plumbing, or electrical repair needs that aren’t clearly visible.

Is there anything special about the home I should know about?

Some houses have that extra “something” that make them more appealing to potential buyers. It could be proximity to a great playground, or some intricate carpentry that really brings out the features over the living room fireplace. Bottom line, some homes have neat characteristics that may not jump out to casual viewers. Current homeowners can help explain these little perks to you.

Why are you selling the home?

This provides you two key pieces of information. First, if it pertains to issues with the home, you’ll gain more insight into the repair needs that the place needs. Second, when you learn someone’s motivation for selling, you can better craft your purchase offer. As real estate investors, we’re problem solvers. Helping a home seller solve his or her problem can be a win-win: get the homeowner cash and find a great deal.

How long have you owned the home?

Normally (though not always), the longer someone has owned a home, the more equity he or she has in that property. When people have equity in a property, they typically have more incentive to sell, as they can convert that equity into cash. Conversely, it can be more challenging finding motivated sellers among homeowners with little to no equity.

How long have you been trying to get rid of the house?

This informs your approach to negotiation. If a homeowner has been trying to sell a place for a year, he or she will likely accept lower offers or more concessions. Alternatively, a homeowner who listed a property a week ago is probably willing to hold out and test the market for a while.

When do you need to move/sell?

Once again, this information can inform your negotiating position. If a homeowner absolutely has to move/sell by a certain date, he or she will likely accept a lower offer in order to meet that deadline. Additionally, investors have an inherent speed advantage. Using cash or hard money loans, we can close on homes far more quickly than people using traditional financing. We can use this fact for negotiating leverage, as well.

When is the earliest you can move?

This information provides you more fidelity on seller motivation – or lack thereof. If a seller responds with something along the lines of “I’ll give you the keys now!” he or she likely has tremendous motivation to make a deal happen. On the other hand, someone in no rush to move may not have the same level of motivation, meaning you may struggle to negotiate a good deal.

How much were you hoping to get?

A saying exists in real estate price negotiations: those who state a price first, lose. As an investor, you never want to be the first party to float a price. Let the seller make this decision, and you can use that as the basis of your negotiations.

How did you decide on that amount?

After sellers state a target price, ask them to explain how they came up with that number. If they can justify the price, it may tell you something about the quality of the deal. If they can’t, you can use that inability to negotiate for a lower price.

What’s the least you would take for all cash and a quick closing?

After a homeowner states an initial target price, I like to follow-up with this question. Psychologically, it seems like I’m offering a benefit, so the homeowner will feel obliged to provide an associated benefit. For example, if a homeowner initially asks for $150,000, and I then ask this, he or she will often want to reciprocate, potentially knocking $5,000 or $10,000 off the asking price on a quick, all-cash closing.

Quick Aside: Investor’s Edge and the Importance of Real Estate Comps Data

The above three questions all revolve around the importance of pricing analysis for real estate investors. If you pay too much for a property, you can crush the back-end profits. Similarly, if you forecast too high of an after repair value, or ARV, you’ll also cut into your profits. Accordingly, real estate investors need to have detailed sales comp data. If you don’t have access to the MLS, you’ll need to access this information from a third-party data aggregator.

At The Investor's Edge, we absolutely recommend our own software, Investor’s Edge. Yes, we’re biased, but we firmly believe that we’re justified in this bias. We poured our entire team’s collective real estate experience into creating the best software for investors. This program provides you access to over 90% of the MLS data in the US market, to include tax records, active properties, and sold property information. Simply put, Investor’s Edge provides you the MLS data you need to make informed real estate investment decisions.

More precisely, our Investor’s Edge software seamlessly lets you complete the following tasks:

Find Deals

With Investor’s Edge, you can sort through over 160 million properties to find the perfect deal, and you can do it instantly. And, to fit your particular investment objectives, you can select from dozens of search parameters, ensuring that you only find the ideal property targets. As these results come in, you can save them all in a single, organized list – no more jotting down tons of different properties onto scratch paper.

Save Your Preferences

No matter how many potential properties exist in a database, it sometimes takes a little while to find a deal that fits your investment objectives. We understand this reality. As a result, Investor’s Edge lets you save all of your exact search parameters. Once created, the software will then automatically update your list of potential deals in accordance with these search parameters. In other words, you set your search criteria once, and Investor’s Edge does the rest, automatically updating your list of potential deals as new properties populate in the MLS.

Market Instantly

But, finding potential deals doesn’t equal actually closing those deals. Once again, we’ve poured our combined decades of real estate experience into our software to address this problem. With Investor’s Edge, you can market instantly to homeowners. As you narrow down your list of potential deals, our software lets you print postcards with pre-filled addresses or send a voicemail directly to these homeowners – for your entire property list!

Now back to the 21 Questions to Ask When Buying a House – Checklist

Are there any title/deed issues with the property?

The last thing you want when you buy a home is to have someone else show up with a claim on that same property. If a home has title/deed issues, you run the risk of a lengthy legal process sorting out the problem. Your real estate attorney or title company can do this background research for you, and you should absolutely purchase title insurance regardless – it’s a one-time expense that can save you a ton of time and money.

Are there any land boundary disputes with neighbors?

Land boundaries issues can cause similar headaches to title/deed problems. If a property sits on a big piece of land – typically outside of a new development – boundary disputes with a neighbor may exist. A homeowner should tell you about any issues, but you likely want to pay for a professional survey regardless, as this will confirm the exact boundaries of a parcel.

Have you done any major repairs? If so, are they up to code?

Unfortunately, when people take a DIY approach to repairs, they often take shortcuts. This may include quality issues, or, more concerning, the repairs may not be up to code. As an investor, you become responsible for these code violations if you purchase a home with them.

Is there a homeowner’s association (HOA)? If so, what does it cover, and what are the fees?

HOAs can be a blessing and a curse. On the one hand, they often handle exterior maintenance, common area upkeep, and landscaping. On the other hand, you need to pay HOA fees, and these associations can be compliance nightmares, making every little thing you do to a home a complete pain. Before buying a home, you’ll want to confirm exactly what a HOA does and how much it charges.

What are the included utilities, and what are the average monthly bills?

Does the house have gas, or is it just electric? This is just one utility-specific piece of information that will affect a future rehab. Additionally, if you plan on leasing the property with a BRRR strategy, you’ll want to have a solid estimate of monthly utility bills, as this will impact your bottom line with renters (unless you pass-through utility responsibility to tenants).

Are there any municipal zoning restrictions?

Some municipalities severely restrict home improvements that change the current layout of a property. Before diving into a deal, you’ll want to consider what is and isn’t allowed with local zoning laws.

Are there any tax liens on the house?

Similar to title issues, tax liens mean someone else has a claim to a property – in this case, the local government. While this may not be a deal-breaker, you’ll want to absolutely know about any tax liens and incorporate those payments into your deal analysis before buying a home.

What school district is the house in, and how is it rated?

This can make a huge difference for potential buyers and renters, and it will certainly factor into the pricing decisions for both fix & flip and BRRR strategies.

What is the current tax-assessed value, and what is the local property tax rate?

This proves particularly relevant to BRRR investors. Property taxes represent a major operating expense for a rental property, so you’ll need to clearly understand these amounts to accurately project future cash flows.

Real Estate Investor Support from The Investor's Edge

In addition to offering hard money loans, we understand that most new investors need some help and guidance during their first deal. We provide this support. Our team will link you up with project managers and advisors to assist you through the entire fix & flip process. For us, we see this as a win-win:

- Win 1: We help new investors by giving them access to hard money loans for which they likely wouldn’t otherwise qualify.

- Win 2: By helping new investors, we help ourselves. We want you to succeed, as this lowers our risk as lenders. And, helping you along the way sets you up for success in that first deal.

With this philosophy in mind, we’ll guide and mentor new investors through the major steps of the fix & flip process.

Finding a Deal

I love to watch HGTV fix & flip shows – they’re entertaining. But, they also do a tremendous disservice to new investors. These shows make it seem as if outstanding deals just fall into your lap as a house flipper. Nothing could be further from the truth.

As a house flipper – new and experienced – you’ll spend the bulk of your time trying to find quality deals with numbers that work for your investment goals. We understand this, and we help investors search and vet deals that’ll work for their situations. As discussed, we offer an incredible resource for finding deals: Investor’s Edge. This software gives you the tools to bridge the gap between a great deal in theory and one in reality.

Finding Contractors and Confirming a Fix & Flip Budget

While we can certainly help you narrow down potential deals, investors eventually need to run accurate numbers. They need to A) find contractors, and B) confirm a fix & flip budget for a potential deal. Without contractor bids, everything is just back-of-the-napkin math. And, while that’s good for narrowing down lists, successful investors need to build and stick to accurate fix & flip budgets. Following an accurate and realistic budget is the key to executing profitable deals.

For new investors, vetting contractors and building a budget can be extremely overwhelming. I understand this (I was a new investor once, too!). Our advisors can help you find and vet reliable contractors in your area. And, we can guide you through the process of working with a contractor to confirm a rehab budget. This doesn’t need to be an overwhelming task. With the right amount of support and guidance, new investors work with contractors to solidify an accurate budget for the deal.

Closing on the Property

Once we help you confirm your fix & flip budget, we’ll move onto actually closing on the property. Hard money lenders don’t release loan funds in a single lump sum. Instead, they issue fund draws based on key milestones. Purchasing the home will be the first such milestone, and we’ll work with you to release these funds and close on the property.

Related to this, new investors may not be familiar with the legal aspects of a home closing. We can help. We’ve been doing this for years, and we intimately understand the legal and regulatory requirements of closing on a home purchase. We will use this experience to support you during the process – and make sure you’ve covered all your bases.

Conducting the Rehab

After closing on the property, our project managers will help you through the entire rehab process. Broadly speaking, this involves two tasks. First, investors need to supervise the contractor team, making sure key deadlines are met. And, second, related to this supervision, fix & flip investors need to monitor – and enforce – the rehab budget. For example, if your budget calls for $10,000 in all new appliances, buying a single refrigerator for $10,000 would blow your entire budget.

This may seem like an extreme example, but a small miscommunication with a contractor could lead to this sort of situation. By closely monitoring and enforcing your budget, you can avoid these inevitable communication SNAFUs. This requires attention to detail and organization, and we can set you up for success. We’ll help you implement the processes that we’ve used flipping houses for years, ensuring that you have an effective and efficient rehab period.

Marketing and Selling the Rehabbed Property

Lastly, investors need to sell their rehabbed properties. This is how you profit on a deal. In basic terms, the excess of the sales price over the purchase, rehab, and holding costs equals your profit. During the rehab process, you try to keep costs down. During the sale, you try to maximize the selling price. By doing these two things, you get the most profit possible from a deal.

However, pricing a property for sale has its own dangers. Price too high, and it sits on the market forever, increasing your holding costs. Price too low, and you may drastically cut into your profit. Unless you’re personally a real estate agent, we recommend working with an agent for the sale. Yes, the agent commission will cut into your profit, but we would’ve already helped you factor this into your budget. And, real estate agents can bring tremendous experience in understanding the local market – and pricing your rehabbed property accordingly.

Our team will help you connect with reliable real estate agents in your area. And, we’ll explain to you all the steps of this process, making you feel comfortable with the entire process – and maximizing your profit, to boot!

Final Thoughts

Buying your first investment property can seem overwhelming. But, if you follow this checklist, you’ll arm yourself with the information you need to make the right decision. Still concerned? Contact us, and we’d love to help you tackle your first deal!

For more help with real estate investing, sign up for our free webinar!