Did you know that real estate is the #1 way that fortunes are made?

It’s true:

According to College Investor:

Over the last two centuries, about 90 percent of the world’s millionaires have been created by investing in real estate.

Um, that’s crazy.

But when you think about it…how else do people become millionaires?

There are people who are CEOs of companies who make tons of money, or there are people who invent something useful, or perhaps the people who start businesses, like an eCommerce store…but other than that, what is there? You could say the people who scrimp and save, but almost all of them have some sort of real estate in their portfolio, even if it’s an REIT.

So let’s face it…if you’re looking for life-changing wealth, the odds tell you that it’s overwhelmingly likely to happen with real estate!

So what’s the best way to invest in real estate? Really, I think it’s any way that you can invest! While there are almost an infinite number of ways to invest in real estate, let me pick 9 ways to highlight.

Crowdfunding Real Estate Platforms

These are relatively new vehicles for investing in real estate! The idea is that if you want to go buy a property yourself, you’re going to spend tons of time & money in finding the property, maintaining it, or flipping it. It feels unreachable for a lot of people.

However, there are new services out there that let you put in as little as $5 and you can own a piece of a property! For example, let’s say that their team has identified a good property for renting out, and it costs $300,000. They open it up to funding on their platform and users fund as much as they’d like until the property is covered. Then each month, you get a percentage of the rental income based on the percentage of the total deal that you funded.

Different companies invest in different types of properties: for example you can invest in Landa and you’ll get a chunk of the rental property. For something like Crowdstreet, you’ll get a piece of a commercial real estate property, but you have to invest at least $25,000 and be an accredited investor—meaning you have a net worth greater than $1 million excluding your primary residence, or you’ve made $200,000 (if you’re single) or $300,000 (married) for each of the past two years.

These services are becoming wildly popular in recent years because you don’t have to maintain a property and yet get a return in real estate. That’s highly desirable.

How to Get Started: Simply get an account with any number of real estate crowdfunding companies, such as Landa, Crowdstreet, or perhaps the most well-known, Fundrise. Full disclosure: I haven’t myself used any of these because I’ve been fix & flipping and owning rentals on my own for almost 20 years. However, I love their business models and have only heard good things from people I know.

Ease: You can choose a platform that invests for you, or you can choose one where you pick which investments you want to get involved in. Those have lower management fees, but require more time and experience. Either way, it’s still a simple way to get into real estate.

Money Required: Whatever you want, really. It can be $5, it can be $50,000, depending on the platform and how much you want to put in.

Returns: Pretty good returns, but on the lower end as far as real estate is concerned. Streitwise advertises historical returns of 9.8%. That’s going to beat almost every other strategy that requires that little effort (except for one we’ll talk about later…).

Risk: Many online are skeptical because the business model is new, however they don’t seem to be any riskier than other more traditional investments.

Buy Property as a Primary Residence

This isn’t seen as a traditional investment strategy, but it certainly is and I want to make sure to include it in my list. I’m referring to you just buying a home to live in. No more renting, no more paying off someone else’s mortgage.

There are just so many advantages to buying your home. Owning property gives you flexibility in the future, such as a cash-out refinance, home equity line of credit, selling it for a profit, moving and then renting it out…seriously, it’s incredible.

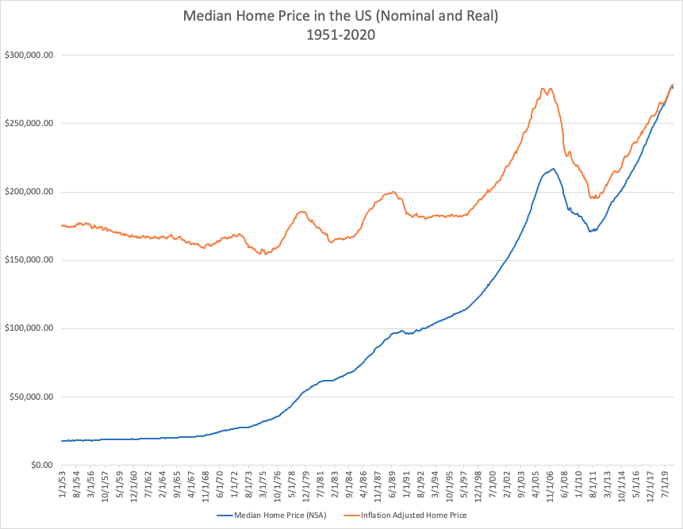

And of course, real estate always goes up in the long run!

Yes, we’ve recovered from the crash of 2008 and have now surpassed those insanely high values from just before the bubble burst! Of course it’s no fun to have purchased a house at the peak of the bubble, but if you bought at almost any other time, you would have seen near-immediate gains in appreciation on your property. If you bought during the bubble, you could hold onto it and eventually be above your purchase price (not to mention that you would’ve paid down a whole lot of the loan by then too!).

How to Get Started: Find a real estate agent and they’ll do the rest!

Ease: Very easy. Millions of people do this every year.

Money Required: Depends. There are a few types of loans where you can get in with 0% down, but those are rare. Otherwise, you’re looking at a minimum of 3.5% down with an FHA loan, but you’ll have to pay mortgage insurance. The average American puts 6% down, so most are well below the standard 20% number that requires no mortgage insurance.

Returns: To be able to use an asset as heavily as you will your house and still have it go up in value significantly over time is remarkable. However, it’s not going to net you a traditional return like with most of these other strategies.

Risk: Little risk, just mostly based on your ability to pay your mortgage each month.

Move and Rent Out Your Own Property

After you buy a home for yourself, you could move out after a few years and rent out the property! One of the reasons this is so appealing is that you never have to pay the 15%-20% down that is standard for purchasing an investment property. This is because both properties you’ve purchased were used as your primary residence at the time you purchased it.

This is the most common way that landlords acquire their first rental property.

How to Get Started: Live in your primary residence for a few years, and then start looking for another to move into! In an ideal world, you’ll have had enough appreciation and paid down enough of the loan that you can do a cash-out refinance to use for your new property’s down payment. That might take more than 2-3 years though.

Ease: Not overly complicated, but you’ll likely want to find a real estate agent who has also done some investing like this to help you out. In my experience that’s the easiest way for a new person to do this well.

Money Required: Can be a lot. You’ll need a down payment for your new house and most banks will want to see 3-6 months’ worth of the mortgage payments of your rental in your bank account. Between these two things, you’re looking at $20k+, depending on the properties of course.

Returns: Pretty good, in the long run. Rentals pay out in several different ways, and you’ll also have your new primary residence to add to your portfolio.

Risk: Not a lot of risk, provided you have the money to cover the mortgage, and sometimes the mortgage on both if you have vacancies.

Buy Your Own Rental Property

Many people who try to go the “buy a property, then move out and keep it” route end up stretching their funds too thin. They’re often younger people who purchase that first house and expect to have the funds to keep the first property when they’re ready to upgrade their primary residence. However, as outlined above, you often need a bunch of cash in a bank account.

This often doesn’t fit their timeline of when they’re ready to move into a bigger home—especially since they’re likely to need to funds from the sale of their first house to move into a new one.

The other option is to wait until you can afford that second rental property. Sure, you’ll have to put down 15%-20% because you’re buying it strictly as a rental, but by waiting until you’re more financially stable, you can make it work and feel better about it.

How to Get Started: Just save up…and then start looking! Again, I’d recommend finding a real estate agent who’s done some of this type of investing before so they can advise you on it.

Ease: This is even simpler to execute than the previous strategy. It’s as easy as finding that second property and then finding a tenant for it.

Money Required: A fair amount. You’ll need the down payment, which could easily be $50k+ and again, the bank will likely want to see that you have the cash to cover several months’ worth of vacancies.

Risk: Little risk. In most areas, especially in the B-class areas that I recommend, you should easily be able to find tenants and keep the place occupied. If the financials ever do get too overwhelming, you sell the place.

Returns: The same as with the other rental strategies discussed. You get your cash flow, tax benefits, appreciation, and have your loan paid down by someone else.

Fix & Flips

Alright. The big one. Many investors consider this the holy grail of real estate investing because it’s perhaps the best way of any strategy in the world to reliably make tens of thousands of dollars on a single deal!

Of course I’m talking about finding a property at a discount from a motivated seller, fixing it up, and then reselling it at a much higher price! This entire site is dedicated to fix & flips. We’re a hard money lender, and most of our loans are for fix & flips (with some BRRR thrown in there), and we have our system that trains people to do fix & flips…so sure, I’m a little biased on this one.

There’s just no other way to make $60k in a few months with $0 out of pocket costs. If you have dreams of a bigger buy & hold project, or you need capital for another venture, or just want to pay off your house quick and take your family on a vacation, then fix & flips are the best.

How to Get Started: You’ll need some training and guidance to make this work. I’d recommend checking out our Find-Fund-Flip System, which is designed to be the only resource you’ll ever need to fix & flip a home. Get started by filling out an application to see if we’re a good fit.

Ease: It’s definitely more difficult than most of the other strategies I’ll talk about in this article. There are many, many steps which could submarine your deal, and others could get you into legal trouble if done incorrectly. However, all those things can be navigated (hundreds of thousands of people do just fine each year) and the reward at the end is worth it.

Money Required: Ranges from $0 to tens of thousands. We specialize in low-to-no cost down payments. In fact 25% of our borrowers bring less than $2,000 to the closing table. That’s an insane number considering that our average paid off loan results in $33,578 in net profit for the borrower.

Risk: Higher risk. There are a lot of values to estimate, many moving parts, and unforeseen issues/emergencies almost always arise. That’s why you need an experienced mentor or team to help you get started.

Returns: Amazing. Incredible. The best. $30k+ on average with potentially $0 out of pocket.

BRRR

Buy, rehab, rent, refinance. This is just really cool. This is for someone who has the capability to flip a home, but then decides to keep it as a rental. The beauty of this is that a traditional rental property (at first) can result in low margins. For example, if there’s a property that you buy and then turn around and rent it out the next day, odds are you aren’t making $500 profit per month from the start or the property wouldn’t have been so cheap.

So what do you do?

You buy a property that you believe has the potential to be a good rental, but then you fix it up. With that forced appreciation and a nicer property, you’ll be able to rent it out for much more than you had originally planned. It’s a seriously great strategy for massively increasing your monthly return on the property without having to wait years to raise the rental price.

How to Get Started: You’ll start by finding a property just as if you were looking for a fix & flip. Something that needs repairs and the owner has motivation to sell it to you at a discount. Once again, we can help you with that and I recommend applying to our Find-Fund-Flip System so you can learn how to pull it off.

Ease: Probably the trickiest strategy on this list. Not only do you have to find a deal, get funding for it, and do the rehab, but then you have to find renters and then refinance your loan into a conventional loan with a low interest rate. Not every bank will jump at the chance to refinance your flip, but we have partners that will and we’ll work with you to make that step happen.

Money Required: The same as a fix & flip. Anywhere from $0 to tens of thousands depending on the deal.

Risk: High. With lots of moving parts, like a fix & flip, except with a more complicated endgame and ongoing rental maintenance. Still worth it.

Returns: Really great. While you won’t get the lump sum of a fix & flip, if you do this right, you could have great cash flow right away and still reap all the long-term benefits of a rental property.

Wholesaling

A wholesale deal is one where you go find a potential fix & flip property and put it under contract. Then you find another investor to assign (or sell) the contract to! You get a finder’s fee for your trouble (often in the $2,500 – $10,000 range) and you get to move on without dealing with the trouble of a flip.

Many new investors love the idea of wholesaling because it’s faster, it’s easier, and you still walk away with thousands of dollars. Then they’ll take that profit and use it to help find a fix & flip property, ready to take on something bigger with their newfound confidence.

I also have friends who own companies that do millions of dollars per year just by wholesaling. If that’s the way you want to go, it’s certainly possible. I prefer fix & flips because I love the rehab project and I love the big check at the end.

How to Get Started: Same as the previous two strategies…look for a property that would be a great candidate for a fix & flip!

Ease: Much simpler than a fix & flip or BRRR because you don’t have to deal with a loan, the rehab, a general contractor, hitting deadlines, etc. The trickiest part is finding a buyer for your deal before you have to back out of the contract. You should start building a list yourself of other real estate investors who’d be interested. We also send out wholesale deals that our members find to a list of 30k active investors.

Money Required: Very little. You might need some money for marketing purposes, and perhaps some earnest money, but it should be minimal.

Risk: Low. If you can’t find a buyer in time, you can back out of the deal and get your earnest money back (if you structured the contract correctly).

Returns: Excellent. $2,500 – $10,000 for a week or two of work with very little cash out of pocket. You can earn much larger sums. I’ve known people to get $50,000 on a wholesale deal because they were flipping a property on the higher end that was going to net hundreds of thousands.

Real Estate Investment Groups (REIGs)

This is similar to the Crowdfunding apps I talked about above, but these are on a larger scale. A company purchases a group of condos or apartment blocks and then investors can purchase one or more units through the company. The company then handles all of the management of the property, including interviewing tenants and doing all the maintenance.

How to Get Started: Find a company online, such as REIG Asset Management.

Ease: Fairly simple because the company does everything for you.

Money Required: A lot. You’re going to be purchasing one or more units.

Risk: Not a ton. Because you’re doing this with a group of investors, the company spreads the risk. Even if you’re specific property has a vacancy, you’ll still earn an income from the shared pool.

Returns: Pretty good, but not like a fix & flip. The company does it’s research to find good properties, but you do have to pay them a management fee.

Private/Hard Money Lender

Now, onto my favorite…becoming a private or hard money lender! In this strategy, you’ll need to have some money, but you’ll get the most returns for just about no work.

Typically a private lender is more non-specific—they’re someone with money who’s willing to invest in any good business proposition that comes along. On the other hand, a hard money lender is someone who specializes in real estate lending.

In fact, I believe that every real estate investors SHOULD eventually turn to lending at some point. My first property was fixing up a duplex and renting out the other side. I quickly moved to fix & flips where I did several hundred. Then I moved into lending. It’s the most sustainable, low-risk, high profit, little work venture in the world. While I still have rental properties and do the occasional flip, I focus mostly on hard money lending. I started The Investor's Edge just as a way for me to fund some deals, but it’s evolved into a 25-person operation funding many deals per month.

How to Get Started: There are lots of people who want to fix & flip and are ready to put in the work…but don’t have the money. The money is the hard part. You need to network, online and in-person, you can run ads, you can talk to your friends and family…it’s really not that hard to get your money working for you.

Ease: Very simple. You just provide the money while the fix & flipper does the work. Just always, ALWAYS put everything in writing, even if it’s a close friend or family member.

Money Required: Little to a lot. You could start as a gap financer where you just cover what the other person is missing to make the deal happen. It could be as low as $2,000. Or, you could fund the entire deal and spend hundreds of thousands.

Risk: Not as much as you might think. As the lender, you should pretty much always be able to get your money back because you get paid first, and then the fix & flipper gets paid second. If the borrower doesn’t hold up their end, you get the property. You might not want it, but at least you’ll have options at that point to fix & flip it or find another investor who wants to take the property.

Returns: Fantastic. Many hard money lenders are doing 12% to 20% without doing any of the work themselves. That’s predictable cash flow that is less subject to the deal itself doing well.

Conclusion

No matter your current skill level, finances, desire to be hands-on, or level of risk you’ll take on, there’s a type of real estate investing that will work for you.

If I were just starting out today, I’d definitely start with wholesaling. It’s fast and low-risk, and I don’t need a bunch of capital to get started. Then, I’d use that profit to jump into a fix & flip. I can use my money to complete the deal or I can either get a 100% financed loan or I can find partners who’ll fund the deal for me.

However, for someone less hands-on, starting with a crowdfunding real estate platform might be the way to go, especially with a service like Landa. They advertise that you can get started for just $5. Even if you don’t have much to invest, starting with a few dollars a month will begin to put you in the right habits and the right mindset.

Hope that helps, and please reach out if you have any cool real estate success stories…I love hearing them!

COMMENTS