100% Hard Money Financing

- No Money Down Real Estate Loans are Possible for You

- Your Step-by-Step Approach to Flipping for Killer Profits

- Advanced Finding Strategies for Deeply Discounted Properties

- How to Accurately Value Properties so You Rarely Lose Money

- Your Private Money Lender with up to 100% Financing for real estate investing

We Have an Exclusive Community of People Just Like You Who are Creating Time and Money Freedom Through Real Estate Investing.

Fill out the application and then one of our Investment Associates will reach out to talk with you to see if you qualify.

What is 100% Hard Money Financing and what does 100% financing mean?

A hard money loan is a short-term financing option that bases terms on real estate rather than a borrower’s credit score.

Unlike a traditional mortgage, a hard money lender will use the property as collateral, making this loan a more accessible and popular option for house flippers.

When examining hard money loan financing options, you should be aware of three types of costs:

- Purchase cost: A purchase cost includes the amount of money it takes to buy the property before performing any work and additional closing costs.

- Repair costs: Your repair costs include any expenses associated with fixing your purchased property and any additional renovations you perform, such as contract work, cosmetic repairs, and maintenance repairs.

- Loans and closing costs: These are the costs you incur in order to close a loan and purchase a house, such as title insurance fees and loan closing costs.

In some cases, a flipper may be eligible for a 100% hard money financed loan.

For most real estate hard money lenders, 100% financing means they will lend a borrower up to 100% of the purchase price.

For example, the lender will provide 90% financing for repair costs while the borrower brings the loan and closing costs to the transaction.

However, we do things differently at The Investor's Edge, offering genuine 100% financing for all eligible borrowers.

What Does 100% Financing Mean?

We’ve covered what hard money is, but what exactly is a 100% hard money financed loan?

This can be a little trickier because every hard money lender has their own definition.

There are three different categories of costs for a fix and flipper completing a deal:

"I went from a part-time salary to well over a six-figure income. We brought zero dollars to the table on this deal...We're looking at a $55k - $60k profit."

- Lauren, Indianapolis

Why Use The Investor's Edge for Your 100% Hard Money Financing

We are the industry-leading hard money lenders for new investors and experienced pros. We even accept many borrowers who have been rejected by other funding options. If you have a little experience with real estate but not a lot of success, we provide the tools to help you get there. We have the lending, training, and software to guide you in becoming a successful house flipper.

Another thing that sets us apart is that with most hard money lenders, you’ll be required to bring 20% or more of total project costs to the closing table, often totaling $30k – $50k—even with lenders that advertise 100% financing.

Our 100% financing, on the other hand, means we’ll cover repair and loan/closing costs in addition to the home purchase price for approved investors.

We’re the only hard money lender that offers true 100% financing. In other words, for great deals, we don’t require our borrowers to bring any cash-to-close. While other lenders won’t take on that much risk, our proven system, risk evaluation, and resources have allowed our borrowers to thrive even without putting any money down. This financing option is even possible for new investors. If you show us a great deal worth investing in, we can help you finance it. This simple philosophy is what makes us different than the competitors.

Along with better funding open to a broader range of investors, we offer additional benefits that other lenders don’t, like providing loan advisors and project managers to help you make the best decisions when flipping homes.

Start with Less Cash

With the right work ethic, anyone can be a great real estate investor — even if they don’t have any money to start the process.

At The Investor's Edge, we want to give all house flippers an equal opportunity to get started.

When you choose us as your fix and flip hard money lender, we’ll help you through the entire flipping process and discuss your funding options. Instead of worrying about your application, funding, and property values, you can focus on the real work of turning your property into something extraordinary.

Whether you’re starting with $5,000 to your name or $30,000, we’re here to help you fund all of your house flipping projects.

Less Risk For You

While funding from The Investor's Edge is not risk-free, our funding options mean more of the risk shifts to us, resulting in lower financial threats for you.

Since you’re less likely to lose big on bad deals, you can focus more on getting to work and flipping properties while we take the burden of risk.

Once you work with us, you’ll learn why we are one of the top hard money lenders for first-time investors.

More Deals At Once

If each deal costs you $30k or more to complete, that’s going to limit the number of deals that you can do at once.

While we recommend not taking on too much at once (especially if you’re new), we also don’t want you to wait 6 months for your deal to finish to start on the next one. With 100% financing, you can afford to start on that next deal whenever you’re ready.

How Do You Qualify for 100% Hard Money Financing?

The main number that you need to keep in mind is 74%.

We are willing to lend up to 74% of a property’s after repair value (ARV)—so if you can fit all your costs under that 74% number, then you’ve got a great shot at 100% financing.

Here’s how that looks:

Let’s say that you find a property that you believe will sell for $300k once you’ve fixed it up and sold it.

$300,000 x 74% = $222,000

Our main qualifying factor for 100% financing is that you get a great deal on a house. The Investor's Edge is a private hard money lender that lends to anyone who meets the criteria. With us, experience is not a factor in who gets 100% money financing.

Our financing means we’ll lend you up to $222,000 for a house with an ARV of $300,000. If you can purchase the house, repair it, and cover closing and loan costs with that amount, you’re likely to qualify for our 100% financing option.

Let’s break that down a little further. You believe it’s going to cost you $50k to fix it up, and another $20k in closing and loan costs.

That means your target purchase price for that property is $152,000. To get the $152,000, we took the $220,000 and subtracted $50,000 for the rehab and $20,000 for closing and loan costs. That leaves us with $152,000 for the purchase price. If you can secure that price, you’ll likely qualify!

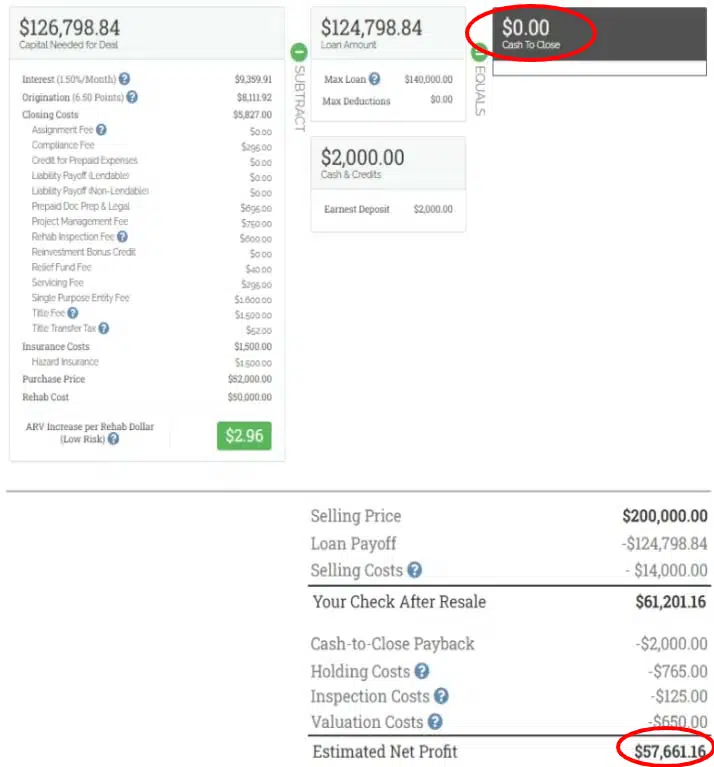

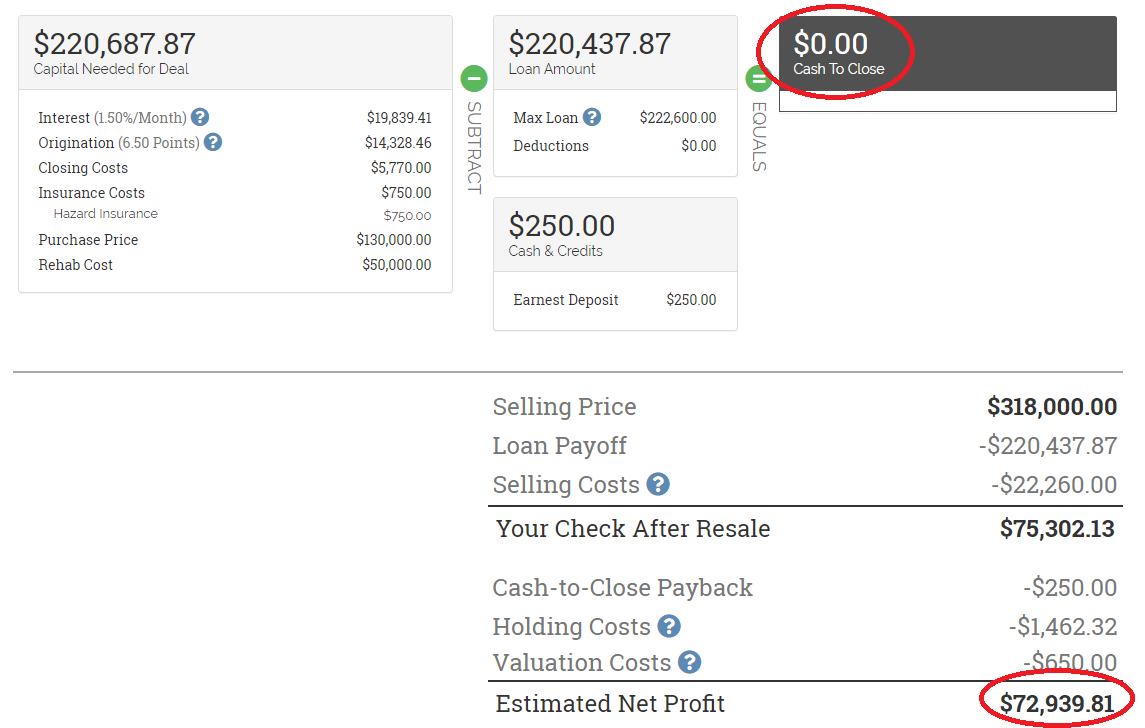

Here’s a real-life example of a deal that one of our members found. These numbers were calculated using our proprietary Advanced Deal Analyzer software:

$0 cash-to-close with an estimated net profit of nearly $60k.

Those are the kind of home run deals that our members bring us over and over again using our system.

We Evaluate Deals, Not People

You’ll notice that not once in that previous section did we talk about our borrower’s requirements.

That’s because we’re focused 100% on the profitability of the deal.

We don’t require:

- Previous experience

- Credit Score

- Minimum Down Payment

No matter who you are, no matter your past (with very few exceptions), and no matter how much money you have or make, you can go out and find a great deal that we’ll finance 100% of the cost.

What If Your Loan Doesn't Qualify for 100% Financing?

Not all loans qualify for 100% financing.

About 37% of our borrowers qualify for 100% financing loans.

However, it’s still possible to make a profit with hard work.

Many house flippers can be financially successful without 100% financing.

If your loan doesn’t qualify, don’t turn elsewhere for funds. We still have great options for you.

Only the best deals qualify for 100% financing—37% of our borrowers qualify for 100% financing loans—but that doesn’t mean it’s not a good deal.

In fact, our median cash-to-close number is $2,183—much lower than what borrowers pay with every other hard money lender out there.

While looking for deals that qualify for 100% financing, you’ll still come across these types of deals—ones that require $5k cash-to-close, but can result in $30k or more in profit.

But what if you don’t have $5k?

The first thing you do is to try to negotiate the price downward. Explain to the seller that in order to make the deal work that you need that price.

If that doesn’t work, we’ll teach you how to find other sources of money which is a major part of our system. A significant benefit and draw of our system is educating our customers. This is why we’re great hard money lenders for new investors. We’ll teach you strategies such as:

- Home equity line of credit

- Retirement accounts

- “Love” money

The point is this: Don’t step over quarters looking for a dollar.

Take these deals along the way, even if they’re not the perfect 100% financing deals you’re looking for.

Even without 100% financing, you can still make a profit on a house.

As you continue to educate yourself on the flipping market, you may earn 100% financing on future projects.

Here's How Our House Flipping System Works:

1. Master Finding Off-Market Deals

Members get access to our Investor's Edge Software, our deal-finding software with access to over 160 million property records in the US.

Sort by foreclosures, liens, cash buyers, vacancies, absentee owners and much more. Our members report that finding potential deals is no longer a problem.

Watch a quick demo where I find potential deals (and send them postcards) within 12 minutes!

2. Marketing Resources

The better you are at finding and closing, the more properties you bring us. It’s a classic win/win.

That’s why our system includes:

Postcard templates

Phone scripts

Contract templates

Motivated seller checklists

Rehab checklists and estimates

And much more. We put everything we could think of in there.

3. Advanced Deal Analyzer

Once you think you’ve got a decent deal on your hands, head on over to our Advanced Deal Analyzer software. Plug in your purchase price, rehab costs, and After Repair Value and you’ll see a complete breakdown of all your costs.

Within a few seconds, you’ll know if you’ve got a viable deal that qualifies for our 100% financing program, or if you’ll need some cash-to-close.

Our successful members use this tool almost daily.

4. Two-Step Evaluation Process

After you’ve plugged in numbers into the Advanced Deal Analyzer and you bring the deal to our attention, we’ll then do our own research.

Our 2-step evaluation involves a virtual assessment done by a member of our team. At that point we’ll then hire 2 independent experts to assign values to the property.

If everything checks out, then it’s time to move ahead. We’ll do everything in our power to keep you from getting into losing deals.

5. Up To 100% Funding On Your Next Deal

We have members that have completed a fix and flip with $0 cash-to-close!

Not all deals are created equal. For really great deals with lots of equity we provide up to 100% funding. With that said, there are good deals that will require some cash to close, but are still really profitable and should be flipped.

We work with you to help you qualify deals before you ever get them under contract so you will have a good idea on how much funding your deal will be approved for.

It doesn't matter if you have bad credit and no flips under your belt... all we care about is the profitability of your deal. You don't need experience because we have it, and we'll be there every step of the way.

See a copy of an actual 100% funding deal that we funded in Lousiana with one of our members!

6. Loan Rates and Details

- No minimum credit score

- No experience required

- Up to 100% financing

- Interest rates beginning at 12%

- Origination as low as 3.5%

- Lend up to 74% ARV

- Loans up to $350k

- No prepayment penalties

- No payments for 5 months

Note: This is only for real estate investment properties up to 4 units. We don't fund commercial properties. We don't fund personal residences (It must be vacant for the rehab). We also don't fund personal loans/business loans (Not really related, but we get that question a lot).

7. Step-By-Step Through The Rehab Process

Rehabbing a property is complicated.

You have to manage general contractors, bids, loan deadlines, emergencies, figuring out what to rehab, and supervising the project.

That's why we'll assign you a former general contractor to act as your project manager, as well as a dedicated loan servicer to check in with you.

We're only as successful as you are... so we'll do everything we can to make this work!

8. Sell the House, Take Your Profits, and Do It Again!

This is what it is all about.

You sell the property at the After Repair Value, pay off your loan, and take your profits.

Make sure you do something to celebrate and then start the process all over again with us. We can help you flip multiple properties at a time once you have some experience under your belt.

Ready to Take The First Step?

Where We Lend:

We currently lend in 39 out of the 50 states in the United States.

Because of different restrictions and regulations state-by-state, we can’t lend in every state.

At the moment, we don't lend in California, Nevada, Utah, Alaska, Minnesota, North Dakota, South Dakota, Vermont, Oregon, Idaho and Hawaii.

Ptolemy's Review:

Ptolemy has 20 years experience as a teacher, but wanted to start supplementing his teacher salary with some real estate deals. He researched a lot of hard money lenders, but chose The Investor's Edge for his first deal because we work with 1st time flippers and walk them through the process. He is expecting to make around $80,000 to $100,000 in profit on this flip. He wants to do more flips to upgrade his lifestyle for himself, his wife, and his kids. Watch his experience now.

Choose The Investor's Edge

While we do fund deals for experienced investors, our main goal is to help new investors get started.

That’s why we created a sustainable way to do just that with our system.

Then we put together loan programs that make sense for everyone.

We want to remove barriers to entry for first-time flippers.

We’re focused on your success.

We provide training and software so that you can make a profit in the house flipping business.

We’re willing to take on more risk because we have the experience and systems in place to give you the best chance of success.

We’ve been in the business for over 20 years and have hundreds of videos and five types of software to help you become an experienced flipper.

Plus, it just makes us happier to give people a shot at financial freedom, as long as they’re willing to work hard.

Let’s work together to flip your first (or next) deal.