Proof of Funds Letters

Proof of Funds Letters So You Can Get Under Contract Quickly

Are you familiar with proof of funds letters?

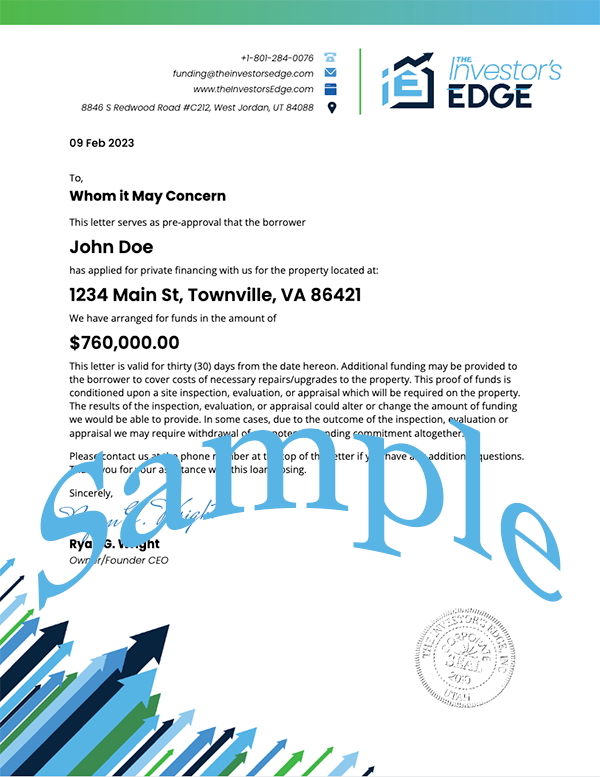

These documents certify how much money you have available to use toward your real estate investment purchase.

In many real estate transactions, you would get a proof of funds letter from your bank, which confirms to the seller that you have the necessary funding available.

However, when you work with The Investor's Edge, you get your proof of funds letter from us because we provide the funding you need for your property investments.

We provide up to 100% funding for your real estate investment project, including the price of the property, closing costs, and any other fees — even rehab costs. That's a lot better than 20%-30% down that our competitors require.

Ready to Take The First Step?

A Proof Of Funds Letter Can Help You Push Your Real Estate Investment Through Faster and Beat Out The Competition:

Shows Credibility

A proof of funds letter from a private lender for real estate shows investors you are prepared to buy. Having a relationship with a private money lender shows the owner you mean business, you’re not new to the game, and you can be trusted to complete the deal.

Speeds Up The Transaction

Having a working relationship with a hard money lender means your transactions go through quickly. That’s because The Investor's Edge has already vetted you.

All we have to do after that is look at your intended real estate investment purchase and approve it.

Property owners don’t want to wait around for small-time real estate investing firms or individuals to get approval for loans. They want to unload their fixer-upper ASAP.

Streamlines The Process

Loan approvals can be notoriously difficult and lengthy.

Hard cash loans are known to be faster because private money lenders do not spend much time delving into personal finances.

What is important is the property itself, because that is your collateral. Beyond this, once you begin working with The Investor's Edge, all your subsequent real estate investment loans will be easier, because we already have a working relationship, and we trust each other.

A Proof Of Funds Letter Pushes You To The Head Of The Line:

A proof of funds letter from The Investor's Edge imbues investors and real estate investment companies with the respect and authority they need to be taken seriously. This helps you beat out your competition more often, and that helps you—and us—make more money flipping properties.

Ready to Take The First Step?

Once a property is listed for sale, the seller wants to attract as many potential buyers as possible to increase the chances of it selling quickly. They’ll not want to do anything that will jeopardize that action taking place. As they are fielding queries about that listing, one of the most important things they’ll be asked is about the availability of the property. They’re only going to want to have to tell people it is under contract if they’re relatively sure of the buyer. And that is where the verification of funds letter comes into play.

A seller is not going to want to turn away interested parties unless they feel good about any offer they may have accepted. One of the most important aspects of that is being assured that the buyer will have the money to complete the purchase. And that is where a proof of funds letter comes into play.

A seller wants something other than a promise and a smile from the buyer. A properly worded verification of funds letter will give the seller the confidence to put their property under contract.

When it comes to real estate investing, knowing how to properly word your proof of funds letters is crucial to gaining sellers’ confidence and trust.

This type of POF (Proof of Funds) differs from the kind you would get if you were trying to get a mortgage.

No. A proof of funds letter and preapproval are two separate things. A POF letter states that the money is available for the property purchase should specific criteria be met. That is something that you need to understand. When you download a POF from The Investor's Edge, we’re not approving a loan and we’re not even saying that the deal you are pursuing is a good deal. Real estate investment revolves heavily around you researching to decide that a property is worth pursuing. A verification of funds letter gives the property seller enough confidence to allow you access to the property in order for you to complete your due diligence. They’re not going to let just anyone send in appraisers, contractors, and inspectors. But those are the next steps you’ll need to take in order to determine whether or not the deal has a good chance of being profitable.

A pre-approval letter is not the same thing.

If you are needing a proof of funds letter for a real estate investment, specifically for a rehab investment, then the easiest and best answer for this is to use our Proof of Funds Service.

When we issue a verification of funds letter, that in no way indicates that you have been approved for a loan on that property. Our proof of funds letters will always stipulate that the deal needs to meet our lending criteria. What the proof of funds letter tells the seller is that The Investor's Edge does indeed have money available to fund should the property qualify and the borrower is able to complete all of the other steps that would be necessary for closing to take place.

Understanding how verification of funds fits into your real estate investing business will help you approach each possible deal with confidence. Once you understand how The Investor's Edge’s funding process works you’ll be able to streamline your own processes so you can keep things moving in the direction you need and at the pace you desire. So many new real estate investors don’t understand how to utilize proof of funds letters to maximize the number of deals they can pursue. Experienced real estate investors will tell you that they usually need to look at 50-100 potential deals in order to find one that will bring them the desired profits. This makes having a reputable lender behind you incredibly important.

The importance of getting a property under contract cannot be overstated, as this will allow you to get better contract bids and estimates. It will allow you to obtain the inspections that you need. Having that contract makes it possible to get the information you need about the property title and history. Having the property under contract is necessary for everyone else to take you seriously. Getting the proof of funds for your real estate flip is crucial.

The Investor's Edge WANTS to fund your deal!

Once you’ve determined it is time to move forward, you can fill out a funding application and schedule an appointment to discuss the viability of your deal and proceeding with the evaluation and funding. If you want to speak with a member of our team before getting the property under contract, we can discuss some options with you.

Our members with a property under contract can run numbers with a member of our funding team to determine whether or not to proceed with a deal, conduct more due diligence, and walk through with your contractor. Because we are experienced in fix & flip investments and land flipping, we can guide you in ways that another lender cannot. Getting a proof of funds letter from a lender specializing in funding for new investors is also helpful. In working with thousands of beginning flippers, we have come to recognize common mistakes that first-timers make.