Short sales are a favorite way to find fix & flip properties, but they can be tricky. How do you get one across the finish line?

Short sales are enticing for many investors because they’re the closest to a move-in-ready house you’ll find at rock bottom prices. But those low prices come with a catch: you’ve got to convince the original lender to accept your offer.

So how exactly are you supposed to get a mortgage lender to transfer ownership over to you, an unknown entity, at a price less than what’s owed? That’s what I’m going to show you below. But first, let’s talk about what a short sale is, why it’s not a foreclosure, and if it’s worth the whole song and dance the lender puts investors through to get a deal approved. Let’s dive in.

What is a Short Sale?

Many new investors get short sales mixed up with foreclosures so before we go any further, let’s clear up what a short sale is (and isn’t).

“Short sale” is a term used for when a homeowner is behind on their mortgage payments and staring down the barrel of a potential foreclosure. To prevent the foreclosure, the owner works with their real estate agent to list the home for sale on the MLS, explicitly (I hope) detailing that it’s being sold as a short sale. Once the owner has an offer from a potential buyer, they (the owner) then go to their mortgage lender and present the short sale offer to transfer ownership and remove their financial obligation to the lender.

The lender does their number crunching and decides whether or not to accept the offer. They can either accept it outright, come back with a counteroffer, or reject the short sale altogether.

Is a Short Sale a Foreclosure?

Short sales are not foreclosures, but they’re still pretty messy. A foreclosure is both an event and a process (I know, just when you thought you had the hang of this) that ensures the bank or someone else will be taking over ownership of the property via an auction. There’s typically a forced eviction during the foreclosure, leaving the original owner pretty powerless throughout the ordeal.

Short sales, however, give both the homeowner and bank another avenue that saves everyone a headache (or ten). With a short sale, the homeowner still has some power and is involved with the selling process. They’ll still lose ownership and need to move, but it’s less of a hit to their finances and credit score than a foreclosure.

Are Short Sales Worth the Effort?

A short sale is like asking a parent if your friend can stay over. In all likelihood, there’s going to be a “yes,” but your parent might set some ground rules that you’ll need to follow.

If you’re someone that has trouble dealing with authority, then short sales are going to take some effort to get through. If you’re excellent at dealing with authority, it’s still going to be a hassle, just less so.

You know that real estate investing is risky and has no guarantees. Now throw in a middle manager at some giant lender who’s had a bad day and is now reviewing your offer and is making you sweat it out a little before they’ll give you the OK. It seems like a whole thing, doesn’t it? So is it really worth all jumping through all these hoops?

The answer comes down to two things: the market and your timeline.

Hurdle 1: The Market

Market conditions affect the amount of inventory available in real estate. A buyer’s market means there’s too much inventory to meet demand, so prices are cheap. A seller’s market means there’s more demand than supply, so the prices are a premium.

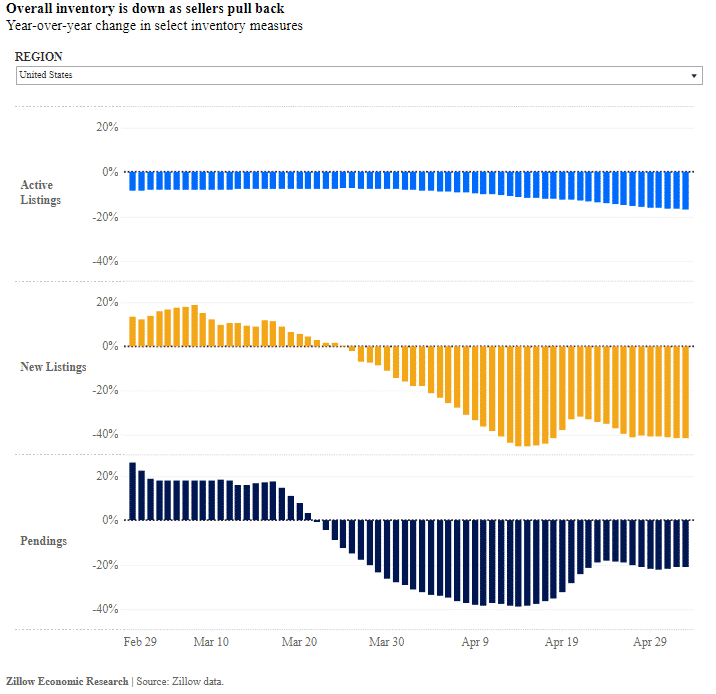

Depending on the type of market you’re facing, it may or may not be worth the effort. For the most part, the overall real estate market for the United States has remained fairly skewed towards favoring sellers and not buyers. Here’s the historical amount of inventory available for purchase according to Zillow:

Source: https://www.zillow.com/research/listings-by-price-tier-coronavirus-26965/

So if you’re a seller, then you’re most likely in a pretty good spot and can take your time to wait for the right offer. If you’re a real estate investor looking for new inventory, you’ve either got to get creative by looking outside of the MLS or come to the offer with a pile of cash.

Hurdle 2: Your Timeline

Short sales aren’t fast. Sure, they’re faster than foreclosures, but you’ve got to deal with the lender’s timeline. It takes time to crunch the numbers and determine whether your offer is more profitable than foreclosing on the owner. It takes an average of 18.6 weeks for a short sale to close. Add to that the six-month average it takes for a flipped house to sell, and you’re close to a year before unloading the property. Can your budget handle that?

How to Get Your Short Sale Approved by the Bank

Let’s say you’re ready to move ahead with an offer for a short sale. How can you hedge your bets to ensure the bank will approve your bid?

- Have your funding or preapproval ready – The easier you make it for the bank to have access to your paperwork, financial documents, and whatever else they need, the more likely you’ll have an answer quickly.

- Work with an agent – Working with a real estate agent isn’t a requirement unless you’re the homeowner but having an agent on your side who’s experienced with short sales is well-worth the commission.

- Stay accessible – Keep lines of communication open with the homeowner, your agent, and the lender. Being hard to get ahold of will only delay things or force the lender to deny your offer because they don’t have what they need to make an approval.

- Don’t forget the homeowner – While the lender has the final say, you’ve got to get the homeowner to accept your offer, too.

- Remove contingencies – Banks are more likely to approve a short sale when there aren’t any contingencies that interfere with the ability to close on the home successfully.

- Be okay with negotiations – In most cases, the bank will counter your offer. Crunch your numbers to see what’s acceptable for your budget. You can use our Advanced Deal Analyzer to help determine how high you can go.

- Stipulate you agree to take over the home “as is” – Unless there are extenuating circumstances, you’ll probably have to accept the property “as is.” Short sales are generally in better condition than foreclosures since they’ve had to go on the market, but that doesn’t mean there couldn’t be problems lurking under the drywall. Have the home inspected, and make sure you know what responsibilities you’re agreeing to take on when closing on the house.

Final Thoughts

Short sales are great ways to find good deals on properties that haven’t been put through the wringer while in foreclosure, but that doesn’t mean they’re easy to get. Know your hard numbers before going in, and stay proactive once the offer is made to ensure you’ll get the sale closed as quickly as possible.

To learn more about real estate investing, sign up for our free webinar!

COMMENTS